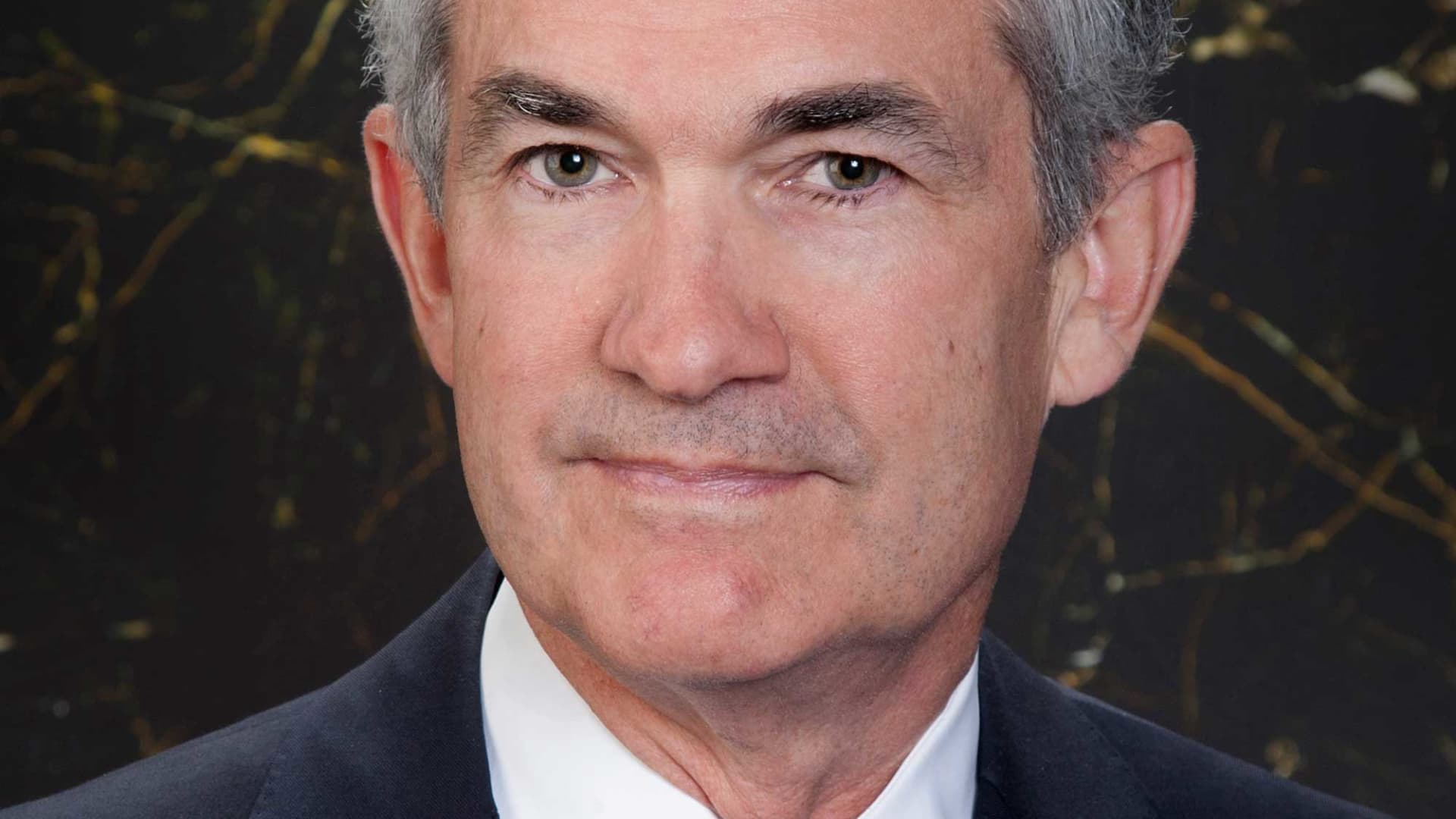

Jerome Powell: The Man Steering The US Economy

Jerome Powell is a name that echoes through the corridors of global finance and economics. As the Chair of the Federal Reserve, his decisions ripple through markets worldwide, affecting everything from interest rates to inflation. But who exactly is Jerome Powell? What makes him the go-to guy for one of the most powerful economic positions in the world? Let’s dive deep into his life, career, and impact on the global economy.

Imagine this: You’re sitting in a room where every decision you make affects millions of people. That’s the reality Jerome Powell lives in every day. From Wall Street to Main Street, his policies shape how we borrow, save, and invest. His role is crucial, and understanding him is like holding the key to decoding modern economic strategies.

In this article, we’ll uncover Jerome Powell’s journey, his leadership style, and how his decisions affect not just the United States but also the global economy. So, buckle up, because we’re about to explore the man behind the Fed.

Biography of Jerome Powell

Early Life and Education

Before Jerome Powell became the Chair of the Federal Reserve, he was just another kid growing up in Washington, D.C. Born on February 4, 1953, Jerome Howard Powell grew up in a family that valued education and hard work. His dad, Jerome Howard Powell Sr., was a lawyer, and his mom, Josephine Powell, was a teacher. These early influences played a significant role in shaping his career path.

Jerome Powell attended George Washington University, where he earned his bachelor’s degree in political science. Later, he pursued a law degree from Georgetown University Law Center. Interestingly, Powell didn’t start his career in economics. Instead, his initial foray into the professional world was through law. But life has a way of surprising us, doesn’t it?

Here’s a quick glance at his educational background:

- Bachelor’s Degree in Political Science from George Washington University

- Law Degree from Georgetown University Law Center

Professional Career

After completing his education, Powell worked as an attorney at the law firm of Dilworth Paxson in Philadelphia. However, his career took a sharp turn when he joined the investment banking world. He worked at Drexel Burnham Lambert and later at The Carlyle Group, where he became a partner. These experiences gave him a solid foundation in finance, which would later prove invaluable.

In 1990, Powell entered the political arena, serving as an Under Secretary of the Treasury for Domestic Finance under President George H.W. Bush. This role provided him with insights into government finance and policy-making. After leaving government service, he returned to the private sector, continuing his work in finance.

Jerome Powell’s Journey to the Federal Reserve

Appointment to the Federal Reserve

Powell’s journey to the Federal Reserve began in 2012 when President Barack Obama nominated him to serve as a Governor of the Federal Reserve Board. He was confirmed by the Senate and officially joined the Fed in May 2012. His appointment was a bipartisan decision, reflecting his reputation as a moderate and pragmatic policymaker.

During his tenure as a Governor, Powell gained a reputation for his data-driven approach and ability to work across party lines. His calm demeanor and analytical skills made him a valuable asset to the Fed. It wasn’t long before he was considered for an even bigger role.

Becoming the Chair of the Federal Reserve

In 2017, President Donald Trump nominated Jerome Powell to succeed Janet Yellen as the Chair of the Federal Reserve. His nomination was seen as a continuation of the Fed’s non-partisan tradition. Powell was confirmed by the Senate in February 2018, and he officially took office on February 5, 2018.

As Chair, Powell faced numerous challenges, including managing interest rates, addressing inflation, and navigating the economic impact of the COVID-19 pandemic. His leadership during these turbulent times has been widely praised for its transparency and decisiveness.

Jerome Powell’s Leadership Style

Data-Driven Decision Making

One of the hallmarks of Jerome Powell’s leadership is his data-driven approach. Unlike some of his predecessors who relied heavily on economic theory, Powell prefers to let the numbers speak for themselves. This approach ensures that his decisions are grounded in reality rather than speculation.

For instance, during the pandemic, Powell and the Fed relied heavily on real-time data to make decisions about monetary policy. This approach helped them respond quickly and effectively to the economic challenges posed by the crisis.

Communication and Transparency

Powell is also known for his emphasis on communication and transparency. He believes that clear communication is essential for maintaining public trust in the Fed. Regular press conferences and public statements are part of his strategy to keep the public informed about the Fed’s policies and decisions.

His transparency has earned him praise from both economists and the general public. People appreciate knowing the reasoning behind the Fed’s actions, and Powell ensures they get that information.

Key Policies Under Jerome Powell

Interest Rate Management

One of the most critical aspects of Jerome Powell’s role is managing interest rates. Interest rates affect everything from mortgage payments to business loans. Under Powell’s leadership, the Fed has taken a measured approach to interest rate adjustments, aiming to balance economic growth with inflation control.

For example, in response to the pandemic, the Fed slashed interest rates to near zero to stimulate the economy. This move was part of a broader effort to provide liquidity and support to businesses and consumers during a challenging time.

Inflation Targeting

Inflation is another key focus area for Powell and the Fed. The Fed aims to maintain an inflation rate of around 2%, which is considered healthy for economic growth. Powell has been vocal about the importance of keeping inflation in check while also supporting economic recovery.

Recent data shows that inflation has been a bit higher than expected, but Powell remains confident that it’s a temporary phenomenon. His approach is to monitor the situation closely and adjust policies as needed.

Impact on the Global Economy

Global Influence

As the Chair of the Federal Reserve, Jerome Powell’s decisions have a global impact. The Fed’s policies affect not just the U.S. economy but also economies around the world. For instance, changes in U.S. interest rates can lead to capital flows that affect exchange rates and investment patterns globally.

Powell’s leadership has been instrumental in maintaining stability during uncertain times. His collaboration with other central banks and international organizations has helped foster global economic cooperation.

Challenges and Opportunities

Despite his successes, Powell faces several challenges. The ongoing effects of the pandemic, rising inflation, and geopolitical tensions are just a few of the issues he must navigate. However, these challenges also present opportunities for innovation and policy reform.

Powell’s ability to adapt and evolve in response to changing circumstances is one of his greatest strengths. His leadership during these challenging times will likely shape the future of global economics for years to come.

Data and Statistics

Economic Indicators

Let’s look at some key economic indicators under Jerome Powell’s leadership:

- Unemployment Rate: Dropped from 14.8% in April 2020 to 3.5% in 2023

- Inflation Rate: Peaked at 9.1% in June 2022 but has since declined

- GDP Growth: Experienced significant fluctuations due to the pandemic

These numbers highlight the impact of Powell’s policies on the U.S. economy. While there have been challenges, the overall trend has been positive, indicating effective management of economic resources.

Challenges Faced by Jerome Powell

Pandemic Response

One of the biggest challenges Jerome Powell faced was the economic fallout from the COVID-19 pandemic. The sudden shutdown of businesses and restrictions on movement led to a sharp decline in economic activity. Powell and the Fed responded swiftly, implementing policies to provide liquidity and support to businesses and consumers.

These measures included cutting interest rates, launching emergency lending programs, and providing guidance to financial institutions. While the recovery has been uneven, Powell’s actions have been credited with preventing a more severe economic downturn.

Inflation Concerns

Inflation has been another significant challenge for Powell. Rising prices have led to concerns about the cost of living and purchasing power. Powell has been cautious in addressing inflation, emphasizing that it’s a temporary issue related to supply chain disruptions and increased demand.

Despite his assurances, some critics argue that the Fed should take more aggressive action to control inflation. Powell remains committed to a balanced approach, prioritizing both economic recovery and price stability.

Future Outlook

What Lies Ahead?

As Jerome Powell continues his tenure as Chair of the Federal Reserve, the future holds both challenges and opportunities. The ongoing recovery from the pandemic, the fight against inflation, and potential geopolitical tensions will all require careful navigation.

Powell’s leadership will be crucial in determining the path forward. His ability to adapt to changing circumstances and make data-driven decisions will be key to maintaining economic stability and growth.

Legacy and Impact

Jerome Powell’s legacy will likely be defined by his leadership during one of the most challenging periods in modern economic history. His decisions have had a profound impact on the U.S. and global economies. As he continues to shape economic policy, his influence will be felt for years to come.

Conclusion

In conclusion, Jerome Powell is more than just the Chair of the Federal Reserve. He’s a leader, a strategist, and a visionary whose decisions affect millions of lives. From his early days in Washington, D.C., to his current role at the helm of the Fed, Powell has demonstrated a commitment to public service and economic stability.

As we’ve explored in this article, Powell’s leadership style, policies, and impact on the global economy are remarkable. His data-driven approach, emphasis on transparency, and ability to navigate challenges have earned him widespread respect.

We encourage you to share your thoughts on Jerome Powell’s leadership. Do you think he’s doing a good job? What challenges do you think he’ll face in the future? Leave a comment below and let’s keep the conversation going!

Table of Contents

- Biography of Jerome Powell

- Early Life and Education

- Professional Career

- Jerome Powell’s Journey to the Federal Reserve

- Appointment to the Federal Reserve

- Becoming the Chair of the Federal Reserve

- Jerome Powell’s Leadership Style

- Data-Driven Decision Making

- Communication and Transparency

- Key Policies Under Jerome Powell

- Interest Rate Management

- Inflation Targeting

- Impact on the Global Economy

- Global Influence

- Challenges and Opportunities

- Data and Statistics

- Economic Indicators

- Challenges Faced by Jerome Powell

- Pandemic Response

- Inflation Concerns

- Future Outlook

- What Lies Ahead?

- Legacy and Impact

Min Vs Nop: A Deep Dive Into The Battle Of Programming Concepts

Brazil Vs Colombia: The Ultimate Showdown On The South American Stage

Matt Rogers: The Digital Marketing Guru Shaping The Modern Business Landscape

104507147Jerome_H._Powell.jpg?v=1529475277&w=1920&h=1080

Jerome Powell Age, Wife, Children, Family, Biography, Facts & More

Jerome Powell