FOMC Meeting Time: Your Ultimate Guide To Understanding The Fed’s Key Decisions

Ever wondered what happens behind closed doors when the Federal Reserve meets? Let me break it down for you. The FOMC meeting time is one of the most critical moments in the financial world. It’s like a big boardroom discussion where decisions are made that could shake up your investments, mortgages, or even your daily coffee budget. So, buckle up because we’re diving deep into the world of central banking, and by the end of this, you’ll be a pro at decoding the Fed’s moves.

Now, you might be thinking, "Why should I care about the FOMC meeting time?" Well, here's the deal: the Federal Open Market Committee (FOMC) controls interest rates, and those rates have a direct impact on your wallet. Whether you're saving for retirement, paying off debt, or just trying to figure out why your credit card bill keeps climbing, the FOMC plays a huge role in all of that.

So, whether you're an investor, a homeowner, or just someone who wants to understand how the economy works, this article’s got you covered. We’ll walk through everything you need to know about FOMC meeting time, including what happens, why it matters, and how you can prepare for it. Let’s get started!

What Exactly is the FOMC Meeting Time?

Let’s start with the basics. The FOMC meeting time refers to the scheduled sessions held by the Federal Open Market Committee. These meetings occur eight times a year, typically lasting for two days. During these sessions, members review economic conditions, assess risks, and make decisions that influence monetary policy. Think of it as a group of financial wizards casting spells on the economy.

Here’s the thing: these meetings aren’t just random gatherings. They’re meticulously planned, and every word spoken during the meetings is scrutinized by economists, traders, and analysts worldwide. The timing of the FOMC meeting is crucial because it sets the stage for significant economic announcements.

Key Players in the FOMC Meeting

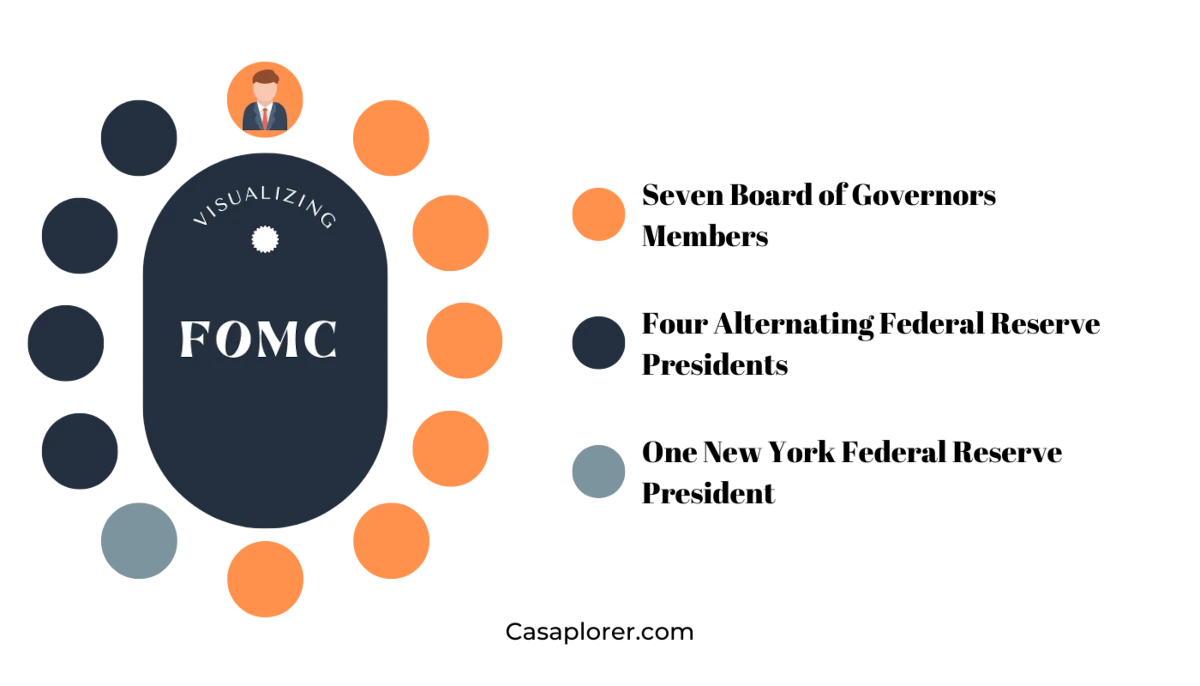

Who’s in the room during the FOMC meeting time? The committee consists of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five Federal Reserve Bank presidents. These guys are the decision-makers, and their votes can shift markets in an instant.

- Jerome Powell: The Chair of the Federal Reserve, often seen as the leader of the pack.

- Other Board Members: Experts in economics, finance, and policy-making.

- Federal Reserve Bank Presidents: Representing regional perspectives and economic insights.

Each member brings unique expertise to the table, ensuring that decisions reflect a broad understanding of the economy.

Why Does the FOMC Meeting Time Matter?

The FOMC meeting time isn’t just another meeting; it’s a pivotal moment that can ripple through the global economy. Here’s why it matters:

First off, the committee decides on interest rates, which directly affect borrowing costs. If rates go up, loans become more expensive, and people might think twice before taking out a mortgage or buying a car. On the flip side, lower rates can stimulate spending and investment, boosting economic growth.

Additionally, the FOMC provides guidance on inflation and employment targets. These targets influence everything from stock prices to job creation. For investors, understanding the FOMC’s stance on inflation can help predict market trends and make informed decisions.

Impact on Global Markets

The FOMC meeting time doesn’t just impact the U.S. economy; it has global implications. Investors worldwide watch these meetings closely because the Fed’s actions can affect currency values, trade balances, and international investments. For instance, a rate hike in the U.S. might strengthen the dollar, making it more expensive for foreign countries to pay off dollar-denominated debts.

So, whether you’re trading stocks, managing a portfolio, or simply trying to understand how the global economy works, the FOMC meeting time is a big deal.

How to Prepare for the FOMC Meeting Time

Now that you know why the FOMC meeting time is important, let’s talk about how you can prepare for it. Whether you’re an investor, a business owner, or just a curious individual, here are some tips to help you stay ahead:

Stay Informed

Keep an eye on economic indicators leading up to the FOMC meeting. Pay attention to data like unemployment rates, GDP growth, and inflation numbers. These figures often shape the committee’s decisions.

Review Past Statements

Reading previous FOMC statements can give you insight into the committee’s thinking. Look for patterns or shifts in language that might signal upcoming changes in policy.

Consult Financial Experts

If you’re unsure about how the FOMC meeting time might affect your investments, consider consulting a financial advisor. They can help you navigate the complexities of monetary policy and tailor strategies to your needs.

Understanding the FOMC Meeting Schedule

Knowing the FOMC meeting schedule is half the battle. The meetings are usually held every six weeks, with the exact dates announced well in advance. Here’s a quick rundown of what to expect:

Each meeting follows a similar structure: the first day involves discussions on economic conditions and policy options, while the second day focuses on decision-making and crafting the official statement. After the meeting, the committee releases a press release summarizing their decisions and provides a press conference where the Chair addresses questions from the media.

Key Dates to Watch

Mark your calendars for these important dates:

- January: Typically the first meeting of the year.

- March: Often includes updated economic projections.

- June: Another key meeting with projections and press conference.

- September: Economic forecasts are released.

- November: A quieter meeting before the holiday season.

- December: Final meeting of the year, often with major announcements.

These dates are crucial for anyone following the markets closely.

Common Misconceptions About the FOMC Meeting Time

There are a few myths floating around about the FOMC meeting time. Let’s clear them up:

One misconception is that the FOMC controls everything about the economy. While they have significant influence, they can’t single-handedly fix unemployment or stop inflation. Their tools are powerful, but they work within the broader context of global economic forces.

Another myth is that the FOMC meeting time only matters to Wall Street. In reality, its impact is felt by everyone, from small business owners to everyday consumers. Understanding the FOMC’s role can help you make smarter financial decisions.

Debunking the "Secret Meeting" Myth

Some people think the FOMC meeting time is a secret gathering where shadowy figures pull the strings of the global economy. Not true. The meetings are highly transparent, with detailed minutes published three weeks after each session. The Fed values accountability and strives to communicate its decisions clearly to the public.

How the FOMC Meeting Time Affects You

Now, let’s talk about how the FOMC meeting time affects your life. Whether you realize it or not, the decisions made during these meetings can have a tangible impact on your finances:

If you have a variable-rate mortgage, a rate hike could mean higher monthly payments. Similarly, if you’re saving for a big purchase, lower interest rates might make borrowing more affordable. Even something as simple as opening a savings account can be influenced by the FOMC’s decisions.

For investors, the FOMC meeting time is a critical moment to reassess portfolios and adjust strategies. Stocks, bonds, and currencies can all move based on the committee’s announcements.

Everyday Impacts

Here are some everyday ways the FOMC meeting time affects you:

- Interest Rates on Loans: Higher rates mean more expensive borrowing.

- Savings Account Yields: Lower rates might reduce the return on your savings.

- Stock Market Fluctuations: Market reactions to FOMC decisions can impact your investments.

Staying informed about the FOMC meeting time can empower you to make better financial choices.

Preparing for the Future: What’s Next for the FOMC?

Looking ahead, the FOMC faces several challenges. Inflation remains a top concern, and the committee must balance economic growth with price stability. Additionally, geopolitical tensions and global supply chain issues continue to pose risks to the U.S. economy.

As we move forward, the FOMC meeting time will likely focus on navigating these challenges while maintaining transparency and accountability. Staying informed and adapting to changing economic conditions will be key for individuals and businesses alike.

Key Takeaways

Here’s what you need to remember about the FOMC meeting time:

- It’s a crucial moment in the financial calendar.

- Decisions made during the meeting impact interest rates, inflation, and employment.

- Staying informed can help you make better financial decisions.

So, whether you’re a seasoned investor or just starting to explore the world of finance, the FOMC meeting time is something you should pay attention to.

Conclusion

In conclusion, the FOMC meeting time is a cornerstone of the global financial system. By understanding its purpose, impact, and implications, you can position yourself to thrive in an ever-changing economic landscape. Remember, knowledge is power, and staying informed about the FOMC’s actions can help you protect your finances and achieve your goals.

Now it’s your turn. Share your thoughts in the comments below. Have you experienced the effects of an FOMC decision firsthand? What strategies do you use to prepare for these meetings? And don’t forget to check out our other articles for more insights into the world of finance. Let’s keep the conversation going!

Table of Contents

- What Exactly is the FOMC Meeting Time?

- Why Does the FOMC Meeting Time Matter?

- How to Prepare for the FOMC Meeting Time

- Understanding the FOMC Meeting Schedule

- Common Misconceptions About the FOMC Meeting Time

- How the FOMC Meeting Time Affects You

- Preparing for the Future: What’s Next for the FOMC?

- Key Takeaways

- Conclusion

NCAA Basketball Scores: Your Ultimate Guide To Staying Updated

Fed Rates: The Pulse Of The Economy That You Need To Understand

Decoding The Department Of Defense: Your Ultimate Guide

FOMC Meeting Schedule

FOMC Live Get the Latest Updates on Interest Rates

FOMC Live Get the Latest Updates on Interest Rates