You Could Be Eligible For A $1,400 IRS Stimulus Check: How To Check If You Qualify

Listen up, folks! The IRS has got something big for you—a potential $1,400 stimulus check! Yeah, you heard me right. This isn't some random internet rumor; it's legit. But here's the deal: not everyone gets to cash in on this sweet deal. So, how do you know if you're eligible? Stick around, because we're diving deep into everything you need to know about this IRS stimulus check and how to check if you qualify.

Let's face it, life can get pretty tough sometimes. Between rent, groceries, bills, and all the other expenses piling up, we could all use a little financial help. Well, the government understands that, and they're stepping in with a stimulus package to give some relief to those who need it most. But don't just assume you're automatically getting the cash. You gotta make sure you meet the requirements.

Now, before we dive into the nitty-gritty details, let me just say this: I'm not a tax expert, but I've done my homework. The info you're about to read comes straight from reliable sources and government websites. So, buckle up, grab a cup of coffee, and let's figure out if you're eligible for this $1,400 IRS stimulus check.

Table of Contents

- Who is Eligible for the $1,400 IRS Stimulus Check?

- Income Requirements for Stimulus Check Eligibility

- Dependents and the Stimulus Check

- Filing Status and Eligibility

- How to Check Your Stimulus Check Eligibility

- How to Apply for the Stimulus Check

- Timeline for Receiving Your Stimulus Check

- How the Stimulus Check Affects Your Taxes

- Common Questions About the Stimulus Check

- Final Thoughts on the IRS Stimulus Check

Who is Eligible for the $1,400 IRS Stimulus Check?

Alright, here’s the big question on everyone's mind: Who gets the $1,400? Let me break it down for you. First off, the IRS has set specific guidelines to determine eligibility. If you're an individual earning under a certain amount, you're in the running. But it's not just about income—there are other factors at play too, like your filing status and dependents.

For individuals, if your adjusted gross income (AGI) is below $75,000, you're likely to get the full amount. For married couples filing jointly, the threshold is $150,000. And for heads of household, it's $112,500. If your income exceeds these limits, don't worry—you might still qualify for a reduced amount. The IRS phases out the payments as income increases, so even if you're just above the limit, there's a chance you'll still get something.

Factors Affecting Eligibility

Now, let’s talk about the other factors that can affect your eligibility. For starters, if you're claimed as a dependent on someone else's tax return, you're not eligible for the payment. That means if your parents are still claiming you on their taxes, you won't get the check. Also, if you don't have a Social Security number, you're out of luck. The IRS requires a valid SSN to process the payment.

Income Requirements for Stimulus Check Eligibility

Income is the biggest factor in determining whether you qualify for the stimulus check. The IRS uses your AGI from your most recent tax return to decide if you're eligible. So, if you haven't filed your 2020 taxes yet, they'll look at your 2019 return. If you haven't filed taxes in the past few years, don't panic. There are ways to update your info with the IRS, which we'll cover later.

Here’s a quick breakdown of the income limits:

- Single filers: $75,000 or less

- Married filing jointly: $150,000 or less

- Head of household: $112,500 or less

What Happens if You Earn More Than the Limits?

If your income is above the limits, don't give up hope just yet. The IRS phases out the payments gradually. For every $100 you earn over the limit, your payment decreases by $5. So, if you're just slightly over the threshold, you might still get a reduced amount. It's not all or nothing, folks.

Dependents and the Stimulus Check

Now, here’s some good news for parents: dependents count too! If you have kids or other dependents, you might qualify for additional payments. For each qualifying dependent, you can receive an extra $1,400. This applies to children under 17, as well as older dependents like college students or disabled adults.

But wait, there's more! The new rules also include older dependents who weren't eligible in previous rounds. So, if you have a college-aged child or an elderly parent you support, they might qualify this time around. It's a game-changer for a lot of families.

How to Claim Dependent Payments

To claim the payments for your dependents, you need to make sure they're listed on your tax return. If you haven't filed your 2020 taxes yet, do it ASAP. The IRS needs accurate info to process your payments. And if you're not required to file taxes, you can still claim the payments by using the Non-Filers tool on the IRS website.

Filing Status and Eligibility

Your filing status plays a big role in determining your eligibility. Whether you're single, married filing jointly, or head of household, it all affects how much you can receive. Let's break it down:

- Single Filers: If you're single and your AGI is under $75,000, you're eligible for the full $1,400.

- Married Filing Jointly: If you're married and your combined AGI is under $150,000, you're eligible for $2,800 (that's $1,400 per person).

- Head of Household: If you're the head of household and your AGI is under $112,500, you're eligible for $1,400.

What If You Recently Got Married or Divorced?

Life happens, right? If you recently got married or divorced, your filing status might have changed. Don't worry—the IRS takes that into account. Just make sure your taxes reflect your current situation, and you'll be good to go.

How to Check Your Stimulus Check Eligibility

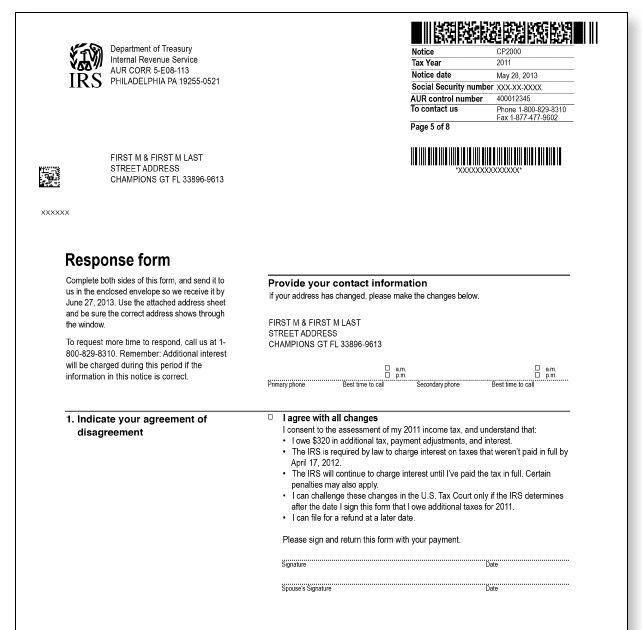

Okay, so you want to know if you qualify. The easiest way to check is by using the IRS's Get My Payment tool. It's a simple online tool that lets you enter your info and see if you're eligible. All you need is your Social Security number, date of birth, and address. The tool will tell you if you're eligible and give you an estimated timeline for receiving your payment.

But what if you don't have internet access? Don't sweat it. You can also call the IRS hotline at 1-800-829-1040. They'll walk you through the process and help you determine your eligibility. Just be prepared for long wait times—it's a busy line!

Tips for Using the IRS Tool

Here are a few tips to make the process smoother:

- Make sure you have all your info handy before you start.

- Double-check your numbers to avoid errors.

- If you don't see your payment info, don't panic. It might just take a little longer to process.

How to Apply for the Stimulus Check

Here's the thing: you don't actually need to "apply" for the stimulus check. The IRS will automatically send payments to those who qualify. But if you haven't filed your taxes or updated your info with the IRS, you need to take action. Here's what you can do:

- File your 2020 taxes ASAP if you haven't already.

- Use the Non-Filers tool on the IRS website to update your info.

- Make sure your bank account info is up to date so the payment can be deposited directly.

What If You Don't Have a Bank Account?

No worries! If you don't have a bank account, the IRS can send your payment by mail. Just make sure your address is current. And if you're worried about security, consider opening a basic savings account. Many banks offer low-cost options for people in need.

Timeline for Receiving Your Stimulus Check

So, when can you expect your payment? The IRS has been working hard to get the checks out as quickly as possible. If you're eligible and have already filed your taxes, you might receive your payment within a few weeks. Direct deposits usually arrive faster than paper checks, so make sure your bank info is up to date.

But remember, the timeline can vary depending on your situation. If the IRS needs more info from you, it might take a little longer. And if you're still waiting for your payment, don't panic. Keep checking the Get My Payment tool for updates.

What If You Don't Receive Your Payment?

If you think you qualify but haven't received your payment, there are steps you can take. First, double-check your eligibility using the IRS tool. If everything checks out, contact the IRS hotline or visit their website for assistance. And if all else fails, you can claim the payment on your next tax return.

How the Stimulus Check Affects Your Taxes

Here's a question a lot of people have: Does the stimulus check affect my taxes? The short answer is no. The payments are not considered taxable income, so you don't have to worry about paying taxes on them. In fact, they're designed to give you financial relief without adding to your tax burden.

However, if you didn't receive the full amount you were entitled to, you can claim the missing amount on your next tax return. It's called the Recovery Rebate Credit, and it's a way to get the money you're owed.

Tips for Tax Season

As tax season approaches, here are a few tips to keep in mind:

- Keep track of all your stimulus payments.

- Make sure your tax info is up to date.

- Claim any missing payments using the Recovery Rebate Credit.

Common Questions About the Stimulus Check

Let’s tackle some of the most common questions people have about the stimulus check:

- Q: Can I get the check if I'm unemployed? A: Yes, as long as you meet the income requirements.

- Q: What if I moved and didn't update my address? A: Use the IRS tool to update your info.

- Q: Do I need to pay taxes on the stimulus check? A: No, the payments are not taxable.

Final Thoughts on the IRS Stimulus Check

Alright, folks, that's the lowdown on the $1,400 IRS stimulus check. If you meet the eligibility requirements, you could be in for a nice surprise. But remember, it's not automatic—you need to make sure your info is up to date with the IRS. File your taxes, update your address, and check your eligibility using the IRS tool.

And here's the kicker: this isn't just free money—it's a lifeline for those who need it most. So, if you qualify, make sure you use that money wisely. Pay off some debt, stock up on essentials, or save it for a rainy day. You've earned it.

Before I sign off, let me leave you with

60-Second Timeout: Timberwolves' Strategic Game Changer

Women's March Madness First Four Updates: Scores, How To Watch Wednesday Games

Turkey Detains Erdogan’s Top Rival In Dawn Raid On Opposition

Irs 3rd Stimulus Check 2021 Recovery Rebate

Irs 2024 Stimulus Check 2024 Pippy Rozanne

Stimulus Check 2025 Irs Gov Travis P. Brown