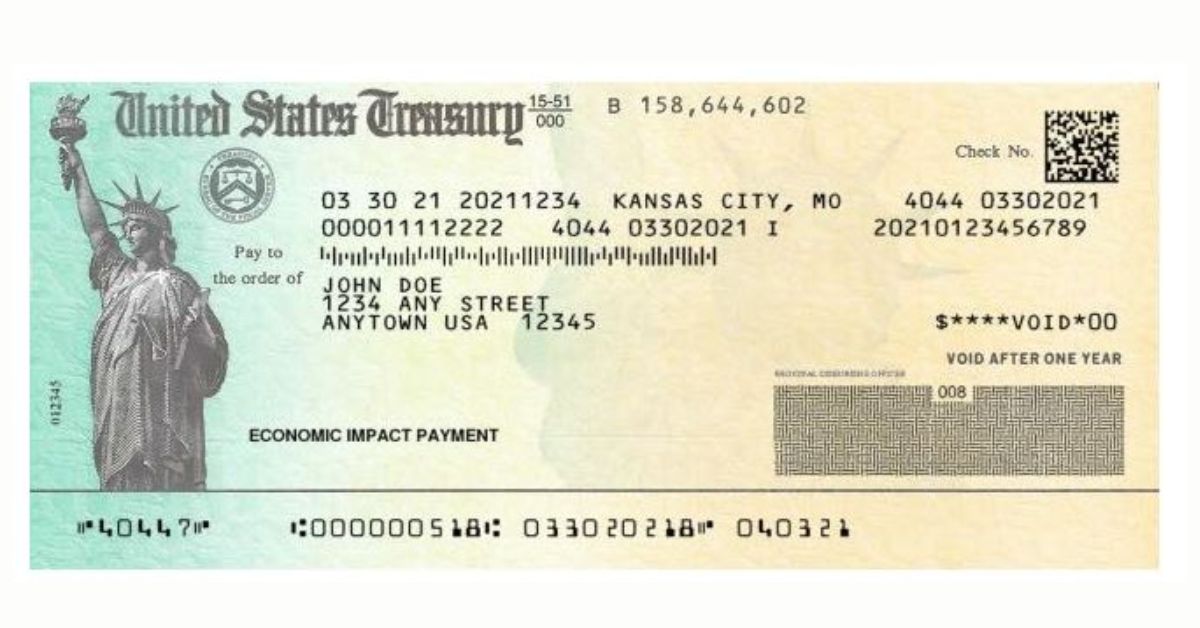

You Could Be Eligible For A $1,400 IRS Stimulus Check: How To Check If You Qualify

Hey there, friend! Let’s talk about something that might just brighten your day—or even your bank account. If you’ve been keeping up with the news, you’ve probably heard about the $1,400 IRS stimulus check. Yep, that’s right! The IRS is handing out some cold hard cash to eligible individuals. But here’s the thing: not everyone gets to cash in on this sweet deal. So, let’s dive into what you need to know to see if you qualify for this sweet stimulus package. Don’t miss out, okay?

Now, I know what you’re thinking. “Do I really qualify? What’s the catch?” Well, there’s no catch per se, but there are certain rules and guidelines you need to follow to make sure you’re in the clear. The IRS has laid out a bunch of criteria, and we’re here to break it down for you in plain English so you can figure out if you’re one of the lucky ones who gets to grab this check.

Before we get into the nitty-gritty, let me just say this: if you’ve been stressing about finances lately, this could be a big help. Whether you’re trying to pay off some bills, stock up on groceries, or just treat yourself to something nice, $1,400 can go a long way. So stick around, and let’s figure out if you’re eligible for this sweet IRS stimulus check. Let’s do this!

Table of Contents

- Who’s Eligible for the $1,400 Stimulus Check?

- Income Requirements: How Much Can You Earn?

- Dependent Rules: What About My Kids?

- Filing Status: Single, Married, or Head of Household?

- How to Check If You Qualify?

- Common Questions About the Stimulus Check

- How Does This Affect My Taxes?

- What Should You Do Next?

- Beware of Scams: How to Stay Safe

- Final Thoughts: Are You Eligible?

Who’s Eligible for the $1,400 Stimulus Check?

Alright, let’s get down to business. Who exactly gets to snag this sweet $1,400 IRS stimulus check? The IRS has set some pretty specific rules, so it’s important to know where you stand. Here’s the deal:

First off, you need to be a U.S. citizen or a qualifying resident alien. If you’re not in the U.S., you’re probably out of luck unless you meet certain residency requirements. But don’t worry, we’ll cover that in a bit. Next, your income needs to fall within certain limits. If you’re earning too much, you might not qualify. And let’s not forget about dependents—they can play a big role in determining your eligibility.

Key Eligibility Factors

- U.S. citizenship or qualifying resident alien status

- Income limits based on your filing status

- Dependent qualifications

- No disqualifying factors like certain tax exemptions

So, if you’re checking all these boxes, you’re on the right track. But let’s break it down even further in the next section. Stick with me!

Income Requirements: How Much Can You Earn?

One of the biggest factors in determining your eligibility is your income. The IRS has set some pretty specific income limits based on your filing status. Here’s what you need to know:

If you’re filing as a single taxpayer, your adjusted gross income (AGI) needs to be under $75,000 to get the full $1,400. If you’re married filing jointly, that limit jumps to $150,000. And if you’re the head of household, you’re good to go as long as your AGI is under $112,500. But here’s the kicker: if you earn more than these amounts, you might still qualify for a reduced payment.

Income Limits at a Glance

- Single: $75,000 or less

- Married Filing Jointly: $150,000 or less

- Head of Household: $112,500 or less

So, if you’re close to these limits, don’t panic. There’s still a chance you could get a partial payment. Just keep those tax documents handy—we’ll need them to figure out if you’re in the clear.

Dependent Rules: What About My Kids?

Now, let’s talk about dependents. This is where things can get a little tricky, but don’t worry—I’ve got you covered. The IRS has expanded the rules for dependents this time around, so more people are eligible than ever before.

In the past, only dependents under the age of 17 qualified for the stimulus check. But this time, the rules have changed. Dependents of all ages can now qualify, including college students, elderly parents, and even disabled dependents. So if you’ve got a big family, this could be a big win for you.

Types of Dependents That Qualify

- Children under 17

- Adult dependents (college students, elderly parents)

- Disabled dependents

Just make sure you’ve claimed these dependents on your tax return. If you haven’t, you might need to update your information with the IRS. It’s a small step, but it could make a big difference in how much you receive.

Filing Status: Single, Married, or Head of Household?

Your filing status plays a big role in determining your eligibility. Whether you’re single, married, or the head of household, it’s important to know how this affects your stimulus check. Here’s a quick rundown:

If you’re single, you need to meet the income limits we talked about earlier. But if you’re married, you and your spouse need to file jointly to qualify for the full amount. And if you’re the head of household, you might have a few extra dependents to consider. It’s all about your specific situation, so don’t be afraid to dig into the details.

Filing Status Breakdown

- Single: File individually

- Married: File jointly for full payment

- Head of Household: File with dependents for increased benefits

So, if you’re not sure about your filing status, now’s the time to figure it out. Trust me, it’ll make a big difference in how much you receive.

How to Check If You Qualify?

Alright, here’s the million-dollar question: how do you check if you qualify for the $1,400 IRS stimulus check? It’s actually pretty simple. All you need to do is pull out your latest tax return and compare your income to the limits we’ve talked about. If you’re within the limits, congratulations—you’re good to go!

But if you’re not sure about your dependents or filing status, you might want to double-check with the IRS. They’ve got a handy tool on their website that can help you figure out if you qualify. Just be careful—there are a lot of scams out there, so stick to official sources like IRS.gov.

Steps to Check Your Eligibility

- Review your latest tax return

- Compare your income to the limits

- Check your dependents and filing status

- Use the IRS tool for confirmation

And if you’re still not sure, don’t hesitate to reach out to a tax professional. They can help you sort through the details and make sure you’re getting everything you’re entitled to.

Common Questions About the Stimulus Check

Let’s address some of the most common questions people have about the $1,400 IRS stimulus check. These are the things that come up over and over again, so I figured it’d be helpful to tackle them right here.

First off, a lot of people want to know if they’ll get the check automatically. The short answer is yes—if you’ve filed your taxes in the last couple of years, the IRS probably already has your information. But if you haven’t filed, you might need to take some extra steps to make sure you’re in the system.

Another big question is about timing. When will the checks actually arrive? Well, the IRS is working hard to get them out as quickly as possible, but it can take a few weeks depending on your situation. If you signed up for direct deposit, you might see your payment sooner than if you’re waiting for a paper check.

Top FAQs

- Will I get the check automatically?

- When will the checks arrive?

- What if I haven’t filed my taxes?

- Can I check the status of my payment?

So, if you’ve got any of these questions, you’re not alone. Just keep checking the IRS website for updates, and you’ll be good to go.

How Does This Affect My Taxes?

Now, let’s talk about the tax implications of this stimulus check. A lot of people are wondering if they’ll have to pay taxes on this money, and the good news is—you don’t! The $1,400 IRS stimulus check is completely tax-free. That means you don’t need to report it on your tax return or worry about any additional taxes.

But here’s the thing: if you didn’t get the full amount you were entitled to, you might be able to claim the Recovery Rebate Credit when you file your taxes. This is a special credit designed to help people who missed out on part of their stimulus payment. So if you think you might qualify, make sure to talk to your tax professional or check out the IRS website for more info.

Key Tax Points

- The stimulus check is tax-free

- Check if you qualify for the Recovery Rebate Credit

- No need to report the payment on your tax return

So, if you were stressing about taxes, you can breathe a sigh of relief. This money is yours to keep, no strings attached.

What Should You Do Next?

Alright, so you’ve figured out if you qualify for the $1,400 IRS stimulus check. Now what? Here’s what you should do next:

First, make sure your information is up to date with the IRS. If you’ve moved or changed banks, you’ll want to update your direct deposit info so you can get your payment as quickly as possible. And if you haven’t filed your taxes yet, now’s the time to do it. The sooner you file, the sooner you’ll get your check.

Once you’ve got everything in order, sit back and wait for your payment to arrive. And when it does, make sure you’re using it wisely. Whether you’re paying off debt, saving for the future, or treating yourself to something nice, this money can go a long way.

Next Steps

- Update your IRS information

- File your taxes if you haven’t already

- Plan how you’ll use the payment

And don’t forget to keep an eye on the IRS website for updates. They’re always releasing new info, so staying informed is key.

Beware of Scams: How to Stay Safe

Finally, let’s talk about scams. Unfortunately, there are a lot of scammers out there trying to take advantage of people during this time. They’ll send fake emails, text messages, or even call you pretending to be the IRS. So how do you stay safe?

First off, remember this: the IRS will never contact you via email or text message to ask for personal information. If you get a message like this, delete it immediately. And if someone calls you claiming to be from the IRS, hang up and call the official IRS number to verify.

Nuggets Podcast: Glory In Golden State, Wizards Weariness, And Nikola Jokic’s Fading MVP Hopes

Javier Aguirre And The New Awakening Of El Tricolor With Santiago Giménez And Raúl Jiménez

Wild's Revival Builds With 4-0 Victory Over Kraken: A Thrilling Comeback In The NHL

Irs 2024 Stimulus Check 2024 Pippy Rozanne

IRS 1,400 Today Stimulus Check Release Date, Eligibility Criteria

Are You One of the 1 Million Taxpayers Eligible for the IRS 1400