FOMC Meeting: The Key To Unlocking The Secrets Of US Monetary Policy

Alright folks, let me tell you something. If you're even remotely interested in how the US economy works or want to understand why the stock market freaks out every few weeks, you better pay attention to the FOMC meeting. This ain't just another boring meeting where a bunch of suits talk about numbers—it's a big deal. The decisions made here can affect everything from your mortgage rates to how much that morning coffee costs. So buckle up, because we’re diving deep into this financial powerhouse.

Now, I know what you're thinking: "Why should I care about some meeting that sounds like it’s straight out of a finance textbook?" Trust me, by the end of this article, you’ll see why this meeting is more than just a bunch of jargon. The Federal Open Market Committee (FOMC) has a massive influence on the economy, and understanding its role can help you make smarter financial decisions. Whether you're an investor, a business owner, or just someone trying to make ends meet, this meeting matters.

So, let’s break it down. The FOMC meeting isn’t just about setting interest rates—it’s about shaping the future of the economy. And if you’re not paying attention, you might miss out on some pretty crucial info that could affect your wallet. Stick with me, and I’ll guide you through everything you need to know about these meetings and why they’re so important.

What is the FOMC Meeting Anyway?

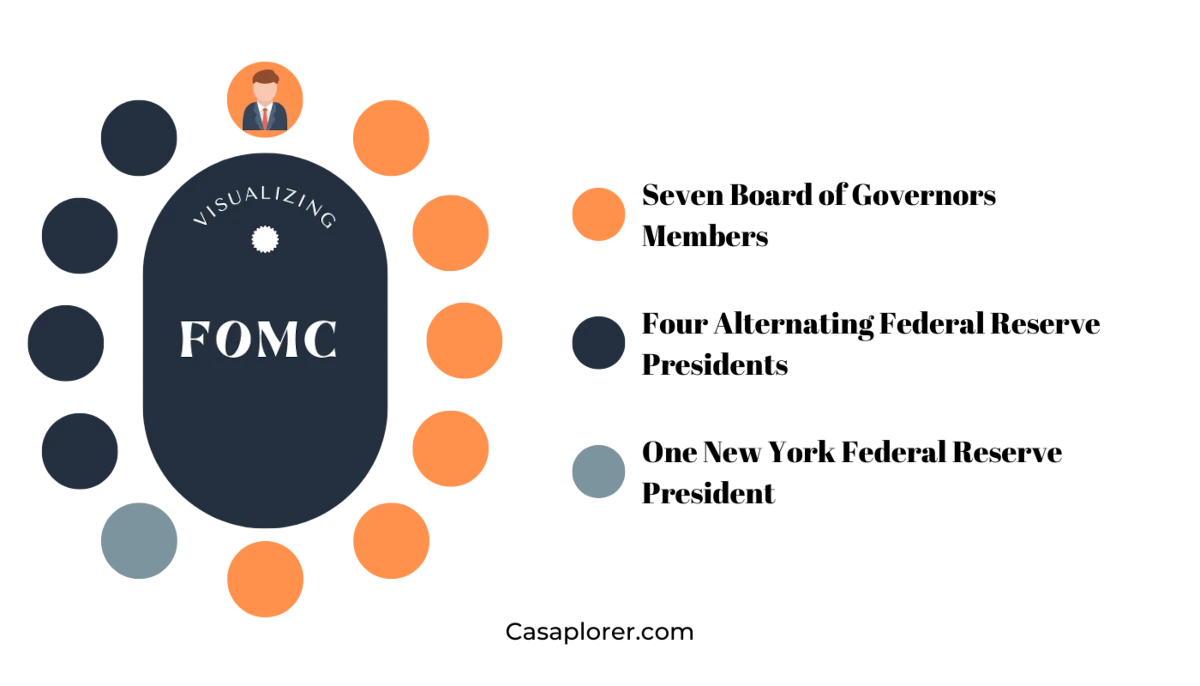

Let's get real here, the Federal Open Market Committee (FOMC) meeting isn’t just another gathering of economists. It’s basically the place where the big decisions about US monetary policy are made. This committee consists of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Reserve Bank presidents. These guys meet eight times a year, and each meeting is a major event for investors, economists, and pretty much anyone who cares about the economy.

Now, what do they talk about in these meetings? Well, it’s all about setting the federal funds rate, which is basically the interest rate banks charge each other for overnight loans. But it doesn’t stop there. They also discuss things like inflation targets, employment levels, and overall economic health. The decisions they make can have a ripple effect on everything from consumer spending to business investments.

Here’s a quick breakdown of what happens during an FOMC meeting:

- Members review economic data to assess the current state of the economy.

- They discuss potential risks and opportunities for the future.

- Based on their analysis, they decide whether to raise, lower, or maintain interest rates.

- Finally, they issue a statement outlining their decisions and the reasoning behind them.

And guess what? This statement isn’t just some boring press release—it’s a treasure trove of information for anyone trying to predict where the economy is headed.

Why Should You Care About the FOMC Meeting?

Look, I get it. You might be thinking, "Why should I care about a bunch of bankers sitting in a room?" But here’s the thing: the FOMC meeting has a direct impact on your life. Whether you realize it or not, the decisions made during these meetings affect everything from your mortgage payments to how much you pay for groceries. If interest rates go up, borrowing money becomes more expensive. If they go down, it becomes cheaper. And that affects everything from buying a house to starting a business.

For investors, the FOMC meeting is like a crystal ball. It gives them insight into where the economy is headed and helps them make informed decisions about where to put their money. And for regular folks like you and me, it’s a chance to understand why our wallets might feel a little lighter—or heavier—depending on what happens in those meetings.

So, whether you’re a stock market guru or just someone trying to make sense of the world, paying attention to the FOMC meeting can give you a leg up. It’s like having a cheat code for understanding the economy.

How Does the FOMC Meeting Work?

Alright, let’s dive into the nitty-gritty of how these meetings actually work. First off, the FOMC meeting isn’t just one meeting—it’s a process. It starts with a lot of preparation. The committee members gather tons of economic data, from inflation rates to employment numbers. They analyze this data to get a clear picture of where the economy stands.

Then, during the actual meeting, they discuss all this info. It’s not just a bunch of guys in suits nodding their heads. There’s actual debate, sometimes heated, about what the best course of action is. Should they raise interest rates to control inflation? Or should they keep them low to stimulate growth? These are the kinds of questions they’re wrestling with.

After the discussion, they vote on what actions to take. And once the decision is made, they issue a statement explaining their reasoning. This statement is closely watched by everyone from Wall Street traders to everyday investors. Why? Because it gives them a glimpse into the Fed’s thinking and helps them predict what might happen next.

Who’s Who in the FOMC?

Let’s talk about the players in this game. The FOMC is made up of 12 members, and each one brings their own expertise to the table. There’s the Board of Governors, which includes the Fed Chair, who’s kind of like the captain of the ship. Then there are the Reserve Bank presidents, who bring a regional perspective to the table. Each member has a vote, but the Fed Chair’s voice carries a lot of weight.

Here’s a quick look at some of the key players:

- Jerome Powell: The current Fed Chair. He’s the guy in charge, and his opinions carry a lot of weight.

- Lael Brainard: A member of the Board of Governors who’s known for her focus on financial stability.

- John Williams: President of the New York Fed, one of the most influential Reserve Banks.

These guys aren’t just faceless bureaucrats—they’re real people with real opinions. And their decisions can have a huge impact on the economy.

What Happens After the FOMC Meeting?

So, the meeting is over, the decision has been made, and the statement has been issued. But what happens next? Well, the real action starts here. Traders and investors start analyzing the statement, looking for clues about where the economy is headed. They’re trying to figure out what the Fed’s decision means for interest rates, inflation, and overall economic growth.

And it’s not just Wall Street that’s paying attention. Regular people like you and me are also affected. If the Fed raises interest rates, borrowing money becomes more expensive. That means if you’re thinking about buying a house or taking out a loan, you might want to act fast. On the other hand, if they lower rates, borrowing becomes cheaper, which can be a good thing for people looking to make big purchases.

But it’s not just about interest rates. The FOMC meeting can also affect things like stock prices, bond yields, and even currency exchange rates. So, whether you’re a seasoned investor or just someone trying to make sense of the world, paying attention to what happens after the meeting can give you a better understanding of where the economy is headed.

How Do FOMC Decisions Affect the Stock Market?

Let’s talk about the stock market for a second. The FOMC meeting can have a huge impact on stock prices. If the Fed raises interest rates, it can make borrowing more expensive for companies, which can hurt their profits. And when profits go down, stock prices often follow. On the other hand, if the Fed lowers rates, it can make borrowing cheaper, which can boost profits and, in turn, stock prices.

But it’s not just about interest rates. The Fed’s statement can also affect investor sentiment. If they sound optimistic about the economy, investors might feel more confident and start buying stocks. If they sound pessimistic, investors might start selling, which can drive prices down.

So, if you’re an investor, paying attention to the FOMC meeting can give you a heads-up on what might happen in the market. And even if you’re not an investor, understanding how these decisions affect the stock market can help you make better financial decisions.

The Impact of FOMC Meetings on the Global Economy

Now, let’s zoom out a bit and look at the bigger picture. The FOMC meeting doesn’t just affect the US economy—it has a global impact. When the Fed raises or lowers interest rates, it can affect everything from currency exchange rates to international trade. For example, if the Fed raises rates, it can make the US dollar stronger, which can make US exports more expensive and hurt companies that rely on international trade.

And it’s not just about the US. Other countries watch the FOMC meeting closely because it can affect their economies too. If the Fed raises rates, it can make US investments more attractive, which can draw money away from other countries. And if they lower rates, it can have the opposite effect, making other countries more attractive to investors.

So, whether you’re a global investor or just someone trying to understand the world, paying attention to the FOMC meeting can give you a better understanding of how the global economy works.

How Do Other Countries React to FOMC Decisions?

Let’s take a look at how other countries react to FOMC decisions. For example, if the Fed raises rates, countries that rely on US exports might see their trade balances affected. And if the dollar gets stronger, it can make it harder for countries with dollar-denominated debt to pay it off. On the flip side, if the Fed lowers rates, it can make other countries more attractive to investors, which can boost their economies.

And it’s not just about trade and investment. The FOMC meeting can also affect geopolitical relations. If the Fed’s decisions hurt a particular country’s economy, it can lead to tensions between the US and that country. So, while the FOMC meeting might seem like just another meeting, its impact can be felt around the world.

Understanding the FOMC Statement

Alright, let’s talk about the FOMC statement. This isn’t just some boring press release—it’s a goldmine of information for anyone trying to understand the economy. The statement is usually issued a few hours after the meeting ends, and it gives a detailed explanation of the committee’s decisions and reasoning.

Now, the statement might seem like a bunch of jargon, but if you know what to look for, it can be pretty easy to understand. First, there’s the decision on interest rates. Did they raise, lower, or keep them the same? Then there’s the reasoning behind the decision. Did they cite inflation concerns? Employment numbers? Overall economic health? All of this information can help you understand where the economy is headed.

But it’s not just about the words—it’s about the tone. If the statement sounds optimistic, it can boost investor confidence. If it sounds pessimistic, it can have the opposite effect. So, whether you’re a seasoned investor or just someone trying to make sense of the world, understanding the FOMC statement can give you a better understanding of the economy.

Key Things to Look for in the FOMC Statement

Here are some key things to look for when reading the FOMC statement:

- Interest Rate Decision: Did they raise, lower, or keep rates the same?

- Inflation Concerns: Did they mention inflation as a concern? If so, what are they planning to do about it?

- Employment Numbers: How are they assessing the job market?

- Overall Economic Health: What’s their take on the economy as a whole?

By paying attention to these key points, you can get a better understanding of where the economy is headed and how it might affect your wallet.

How Can You Prepare for the Next FOMC Meeting?

So, now that you know why the FOMC meeting matters, how can you prepare for the next one? First off, stay informed. Follow economic news and keep an eye on key indicators like inflation rates and employment numbers. This will give you a better understanding of what the Fed might decide.

Second, if you’re an investor, consider adjusting your portfolio based on what you think the Fed might do. If you think they’ll raise rates, you might want to sell some stocks and buy bonds. If you think they’ll lower rates, you might want to do the opposite.

And finally, don’t panic. The FOMC meeting can be a big deal, but it’s not the end of the world. Whatever they decide, the economy will adjust, and life will go on. So, stay calm, stay informed, and most importantly, stay prepared.

Conclusion

Alright, that’s the scoop on the FOMC meeting. From setting interest rates to shaping the future of the economy, these meetings are a big deal. Whether you

Mount St. Mary's Basketball: A Deep Dive Into The Program's Thrilling Journey

American Family Hulu: Your Ultimate Guide To Streaming Family Entertainment

Imogen Faith Reid: The Rising Star Of The Entertainment Industry

FOMC Meetings 2022 and 2023

FOMC Meeting Schedule

FOMC Meeting Schedule