Fed Rate: The Pulse Of The Global Economy

Hey there, finance enthusiasts! If you're diving into the world of economics or just trying to make sense of how interest rates affect your wallet, you're in the right place. Fed rate, short for Federal Reserve interest rate, is one of the most critical factors shaping the global economy. It's like the heartbeat of financial markets, influencing everything from mortgage payments to stock prices. Understanding it can be a game-changer for your financial decisions. So, buckle up and let’s break it down!

Now, you might be wondering, "What exactly is the fed rate?" Simply put, it's the interest rate set by the Federal Reserve, the central bank of the United States. This rate affects borrowing costs for banks, which then trickle down to consumers like you and me. Whether you're planning to buy a house, invest in stocks, or even save for retirement, the fed rate plays a pivotal role in determining the cost of borrowing and the return on savings.

Here's the kicker: the fed rate isn't just a number. It's a powerful tool used by the Fed to control inflation and stabilize the economy. When the economy is overheating, they might raise the rate to cool things down. Conversely, during economic downturns, they can lower it to stimulate growth. It's like a thermostat for the economy, ensuring it stays at just the right temperature. Let's dive deeper into why this matters and how it impacts your life.

Understanding the Basics of Fed Rate

Before we get into the nitty-gritty, let’s talk about the basics. The fed rate, or federal funds rate, is essentially the interest rate at which banks lend reserve balances to other banks on an overnight basis. This rate is set by the Federal Open Market Committee (FOMC), a branch of the Federal Reserve. The FOMC meets eight times a year to decide whether to raise, lower, or maintain the fed rate based on economic conditions.

Here’s a quick rundown of why this matters:

- It impacts borrowing costs: When the fed rate goes up, borrowing becomes more expensive, which can slow down spending and investment.

- It affects savings: Higher rates mean better returns on savings accounts and certificates of deposit (CDs).

- It influences inflation: By tweaking the rate, the Fed can either curb inflation or encourage spending to boost the economy.

In a nutshell, the fed rate is the Fed’s way of keeping the economy in check. It's not just about numbers; it's about balancing growth, stability, and inflation. Now, let’s explore how this rate affects different sectors of the economy.

How Fed Rate Affects the Economy

Picture this: the fed rate is like a lever that the Fed uses to steer the economy. When they pull it one way, it can boost growth. When they push it the other way, it can slow things down. Let’s break it down by sector:

Impact on Consumers

For everyday folks like you and me, the fed rate affects everything from credit card interest rates to car loans. If the fed rate increases, borrowing becomes more expensive, which can lead to reduced consumer spending. On the flip side, higher rates mean better returns on savings, which can encourage people to save more. It's a delicate balance that affects our day-to-day financial decisions.

Impact on Businesses

Businesses also feel the pinch when the fed rate changes. Higher rates mean higher borrowing costs, which can impact everything from expansion plans to hiring decisions. For companies that rely heavily on loans, a rise in the fed rate can be a major challenge. However, stable rates can provide a predictable environment for long-term planning and investment.

Impact on the Stock Market

Now, let’s talk about the stock market. The fed rate has a significant impact on stock prices. When rates are low, companies can borrow more cheaply, boosting profits and stock prices. Conversely, higher rates can lead to a sell-off as investors anticipate lower profits. It's a seesaw effect that keeps traders on their toes.

The History of Fed Rate: A Timeline

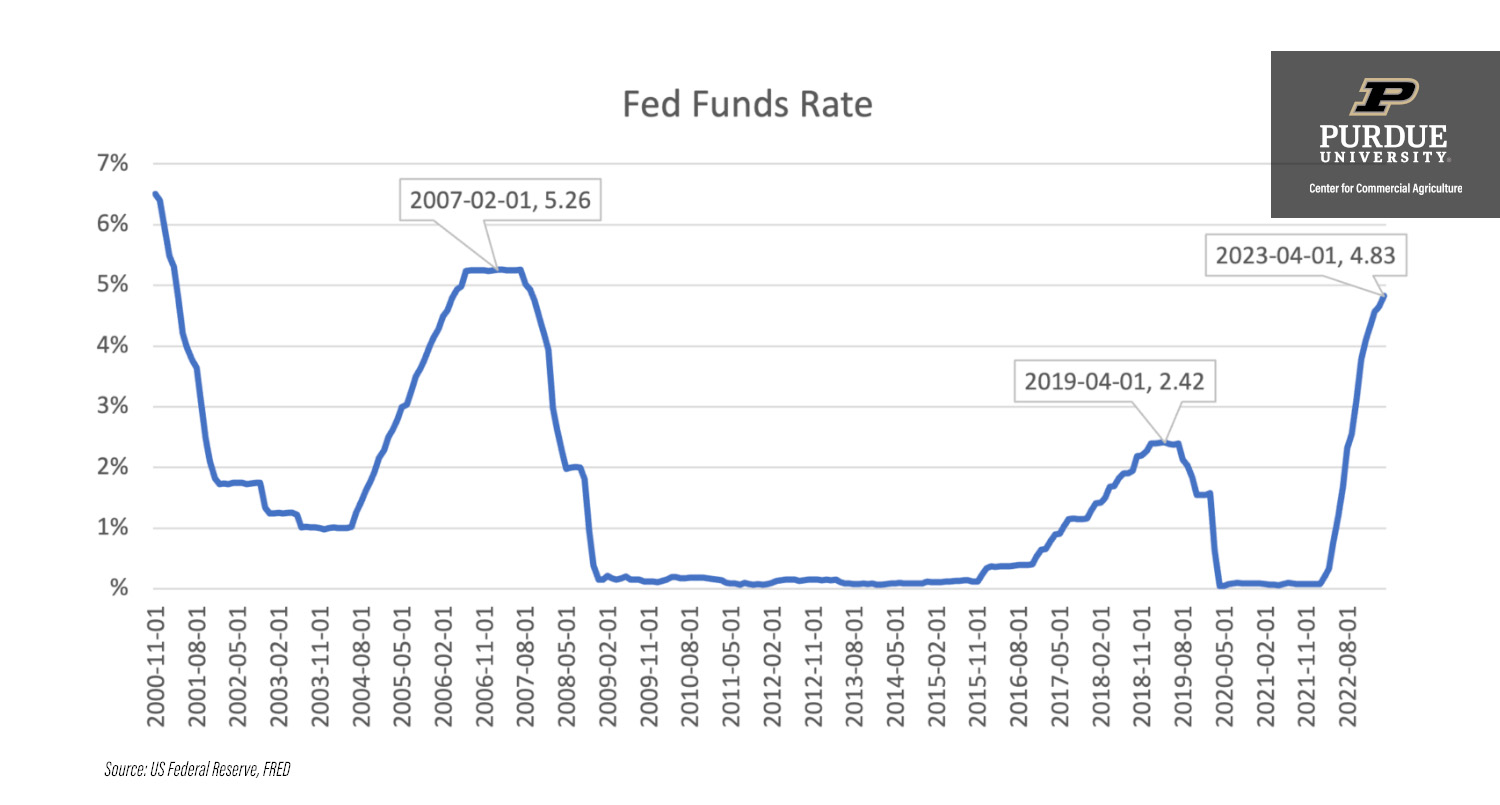

To truly understand the fed rate, it helps to look back at its history. The Federal Reserve was established in 1913, but the concept of the fed rate as we know it today didn't come into play until the 1980s. Here’s a quick timeline:

- 1980s: The Fed aggressively raised rates to combat runaway inflation, peaking at over 20% in 1981.

- 2000s: Rates were lowered during the dot-com bubble burst and the 2008 financial crisis to stimulate the economy.

- 2020s: In response to the COVID-19 pandemic, the Fed slashed rates to near zero to support economic recovery.

This historical context shows how the fed rate has been a crucial tool for navigating economic challenges. It's not just about numbers; it's about adapting to the ever-changing economic landscape.

Factors Influencing Fed Rate Decisions

So, what goes into the Fed’s decision-making process? Several factors come into play:

Economic Growth

If the economy is growing too quickly, the Fed might raise rates to prevent overheating. On the other hand, during a slowdown, they might lower rates to stimulate growth. It's all about maintaining a healthy balance.

Inflation

Inflation is one of the biggest drivers of fed rate decisions. If prices are rising too fast, the Fed will likely raise rates to cool things down. Conversely, if inflation is low, they might lower rates to encourage spending.

Unemployment

Unemployment rates also play a role. If unemployment is high, the Fed might lower rates to encourage job creation. It's all part of their dual mandate to promote maximum employment and stable prices.

How Fed Rate Affects Global Markets

While the fed rate is set by the U.S. Federal Reserve, its impact is felt worldwide. Here’s how:

Foreign Exchange Rates

Changes in the fed rate can influence the value of the U.S. dollar. A higher rate often strengthens the dollar, making it more attractive to foreign investors. This can impact currency exchange rates and international trade.

Global Investments

Investors around the world keep a close eye on the fed rate. A hike in rates can lead to a flow of capital into the U.S., while a cut can send money elsewhere. It's a global game of financial chess that affects markets everywhere.

Long-Term Implications of Fed Rate

While the immediate effects of the fed rate are clear, what about the long-term implications? Here’s what to consider:

Economic Stability

A stable fed rate can foster long-term economic growth. Predictability allows businesses and consumers to plan for the future, reducing uncertainty and promoting stability.

Debt Management

For governments and corporations, managing debt becomes easier with predictable rates. Lower rates can reduce borrowing costs, while higher rates can increase them, impacting budgetary decisions.

Common Misconceptions About Fed Rate

There are a few misconceptions about the fed rate that we need to clear up:

- Myth #1: The fed rate directly controls inflation. While it influences inflation, other factors like supply chain disruptions and energy prices also play a role.

- Myth #2: Lower rates always mean better economic performance. Sometimes, excessively low rates can lead to asset bubbles and unsustainable growth.

Understanding these nuances can help you make more informed financial decisions.

Practical Tips for Navigating Fed Rate Changes

Now that you know the ins and outs of the fed rate, here are some practical tips:

- Monitor economic indicators: Keep an eye on inflation, unemployment, and GDP growth to anticipate fed rate changes.

- Adjust your financial strategy: If rates are rising, consider locking in lower rates on loans or mortgages. If rates are falling, explore investment opportunities.

- Stay informed: Follow FOMC meetings and announcements to stay ahead of the curve.

Being proactive can help you navigate the ever-changing landscape of the fed rate.

Conclusion: Why Fed Rate Matters to You

Alright, let’s wrap things up. The fed rate might seem like just another number, but it has a profound impact on your financial life. Whether you're saving, investing, or borrowing, understanding the fed rate can empower you to make smarter decisions. So, stay informed, stay proactive, and don't be afraid to ask questions.

Before you go, here’s a call to action for you: leave a comment below sharing your thoughts on the fed rate or ask any questions you might have. And if you found this article helpful, don't forget to share it with your friends and family. Together, let’s demystify the world of finance!

Thanks for reading, and until next time, keep crushing those financial goals!

Table of Contents

- Fed Rate: The Pulse of the Global Economy

- Understanding the Basics of Fed Rate

- How Fed Rate Affects the Economy

- The History of Fed Rate: A Timeline

- Factors Influencing Fed Rate Decisions

- How Fed Rate Affects Global Markets

- Long-Term Implications of Fed Rate

- Common Misconceptions About Fed Rate

- Practical Tips for Navigating Fed Rate Changes

- Conclusion: Why Fed Rate Matters to You

Segregated Facilities: The Untold Story Behind Divided Spaces

Jackie Robinson Department Of Defense: The Untold Story You Need To Know

American Culture And Lifestyle: A Deep Dive Into What Makes The USA Unique

Fed interest rate SeetaDenholm

Fed Rate Increases 2025 Tiff Shandra

Fed Increase Rate 2024 Tarah Charlotte