Stock Market Today: Nasdaq Leads Market Rally As Investors Cheer Fed Rate Decision

Today's stock market is buzzing with excitement as the Nasdaq takes the spotlight, leading a major market rally. Investors are thrilled with the Federal Reserve's recent rate decision, sparking optimism across Wall Street. If you're keeping an eye on your portfolio or just curious about what's happening in the financial world, buckle up because it's going to be a wild ride!

Let's dive right into the heart of the matter. The stock market today is not just about numbers; it's about sentiment, strategy, and staying ahead of the game. As the Fed announces its latest move, investors are reacting positively, sending the Nasdaq soaring higher. This isn't just a blip on the radar—it's a trend that could shape the financial landscape for months to come.

But why does the Nasdaq matter so much? Well, it's home to some of the biggest tech giants out there. When these companies do well, the entire market feels the ripple effect. Today, it seems like the stars have aligned for investors, and they're ready to celebrate. So, let's break this down piece by piece and see what's really going on behind the scenes.

What's Driving the Market Rally?

Alright, so you're probably wondering what exactly is driving this market rally. It's not just the Fed's rate decision—it's a combination of factors that have investors feeling pretty good about themselves. The economy is showing signs of resilience, and companies are reporting better-than-expected earnings. This creates a perfect storm of positivity that's sending stocks skyrocketing.

Here are some key factors:

- Fed's rate decision: Lower rates mean cheaper borrowing costs for businesses and consumers alike.

- Strong earnings reports: Companies are beating estimates, which boosts investor confidence.

- Geopolitical stability: For now, there's no major conflict on the horizon, which reduces uncertainty.

When you put all these pieces together, you get a market that's ready to take off. It's like a well-oiled machine, and today, the Nasdaq is leading the charge.

Why Is the Nasdaq So Important?

The Nasdaq isn't just any index—it's the tech-heavy powerhouse that everyone watches closely. Companies like Apple, Microsoft, Amazon, and Google all call the Nasdaq home. When these giants perform well, the entire market benefits. But what makes the Nasdaq so special?

For starters, it's a barometer of innovation. The companies listed on the Nasdaq are at the forefront of technological advancements. Whether it's artificial intelligence, cloud computing, or renewable energy, the Nasdaq is where the action is. And today, with the market rally in full swing, investors are pouring money into these tech darlings.

Key Players in the Nasdaq

Let's take a closer look at some of the key players driving the Nasdaq's performance:

- Apple Inc.: The tech giant continues to dominate with strong sales and innovative products.

- Microsoft Corporation: Cloud services and software solutions keep this company ahead of the curve.

- Amazon.com: E-commerce and AWS are the engines driving Amazon's growth.

- Alphabet Inc.: Google's parent company is making waves with its advertising and AI initiatives.

These companies are not just leaders in their respective fields—they're shaping the future of technology. And when they thrive, the Nasdaq thrives along with them.

How the Fed Rate Decision Affects the Market

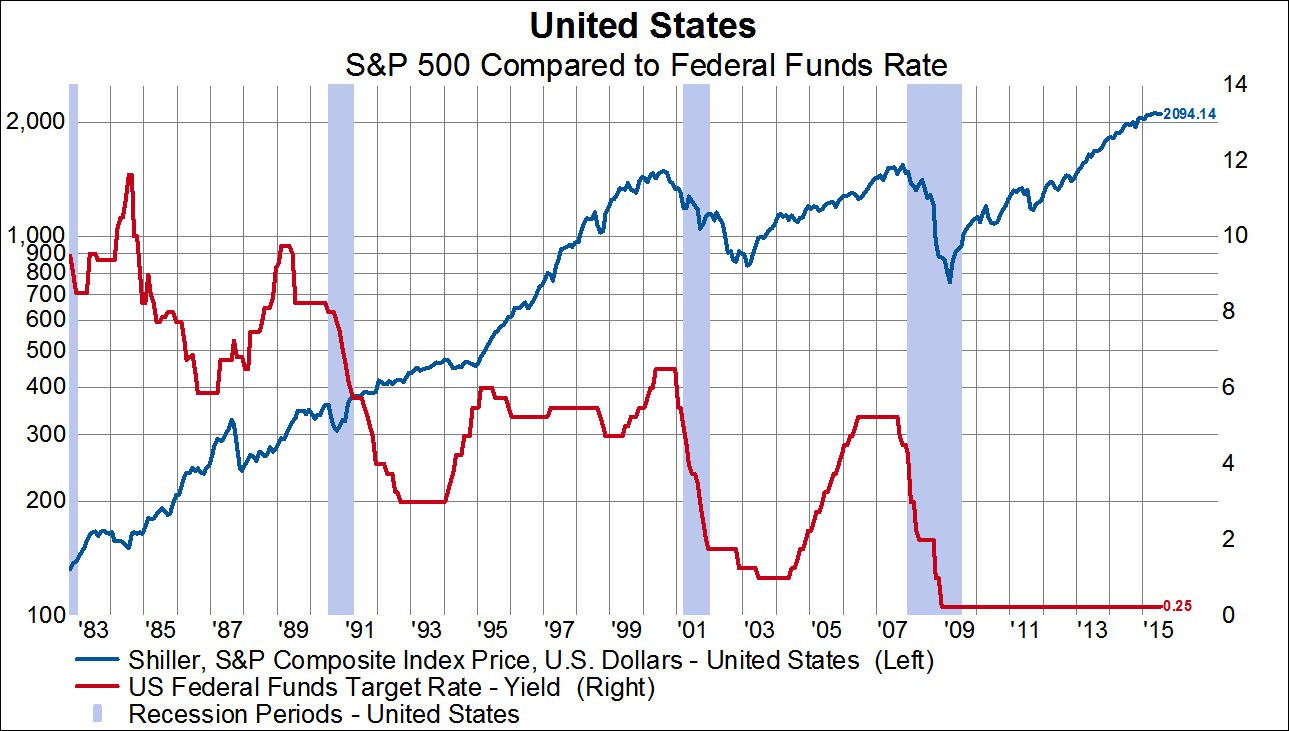

Now, let's talk about the elephant in the room: the Federal Reserve. The Fed's decision to adjust interest rates can have a massive impact on the stock market. Lower rates mean cheaper borrowing costs, which is great news for businesses. It also makes stocks more attractive compared to bonds, since bond yields tend to fall when rates drop.

Investors are cheering the Fed's move because it signals that the central bank is willing to support the economy. This creates a sense of stability and confidence, which is exactly what the market needs right now. And with the Nasdaq leading the charge, it's clear that tech stocks are benefiting the most from this decision.

What to Watch For

While the Fed's rate decision is certainly a positive development, there are still some things to keep an eye on:

- Inflation: If inflation starts to rise too quickly, the Fed may need to act again.

- Economic data: Keep an eye on GDP growth, unemployment rates, and other key indicators.

- Corporate earnings: Companies will need to continue delivering strong results to sustain this rally.

These factors will play a crucial role in determining whether the market rally can continue in the long term.

Investor Sentiment and Market Psychology

Investor sentiment is a powerful force in the stock market. When investors are optimistic, they're more likely to buy stocks, driving prices higher. Today, sentiment is clearly positive, thanks to the Fed's rate decision and strong earnings reports. But what drives this sentiment?

Market psychology plays a big role. Investors are influenced by news, data, and even their own emotions. When they see the Nasdaq rallying, they want to be part of the action. This creates a feedback loop where positive sentiment leads to more buying, which drives prices even higher.

How to Gauge Investor Sentiment

There are several ways to gauge investor sentiment:

- Stock market indices: The performance of major indices like the Nasdaq can provide clues about sentiment.

- Social media: Platforms like Twitter and Reddit can give you a sense of what retail investors are thinking.

- Analyst reports: Professional analysts often provide insights into market trends and sentiment.

By paying attention to these indicators, you can get a better understanding of where the market is headed.

Strategies for Capitalizing on the Market Rally

If you're looking to capitalize on the current market rally, there are a few strategies you can consider:

First, focus on sectors that are benefiting the most from the Fed's rate decision. Tech stocks are a great place to start, but don't overlook other areas like consumer discretionary and financials. These sectors often perform well during periods of economic expansion.

Second, consider diversifying your portfolio. While the Nasdaq is leading the charge, it's important to spread your risk across different asset classes. This can help protect your investments if the market takes a turn for the worse.

Long-Term vs. Short-Term Strategies

When it comes to investing, you have two main options: long-term and short-term strategies. Long-term investors focus on buying and holding stocks for extended periods, while short-term traders look for quick gains.

- Long-term strategy: Buy high-quality companies with strong fundamentals and hold them for years.

- Short-term strategy: Use technical analysis to identify short-term trading opportunities.

Both approaches have their pros and cons, so it's important to choose the one that aligns with your financial goals.

Risks and Challenges in Today's Market

While the market rally is certainly exciting, it's important to be aware of the risks and challenges that lie ahead. Inflation, geopolitical tensions, and unexpected economic data can all derail the current momentum. That's why it's crucial to stay informed and adjust your strategy as needed.

Another challenge is the potential for overvaluation. With stocks soaring to new highs, some analysts are concerned that the market may be getting ahead of itself. This doesn't mean a crash is imminent, but it does highlight the importance of being cautious.

How to Mitigate Risks

Here are some ways to mitigate risks in today's market:

- Set stop-loss orders to limit potential losses.

- Rebalance your portfolio regularly to maintain the right asset allocation.

- Stay informed about economic and geopolitical developments that could impact the market.

By taking these precautions, you can protect your investments and navigate the market with confidence.

Conclusion: What's Next for the Stock Market?

Today's stock market rally, led by the Nasdaq, is a testament to the resilience of the economy and the optimism of investors. The Fed's rate decision has provided a much-needed boost, and companies are delivering strong earnings. But as with any market rally, there are risks and challenges to consider.

To stay ahead of the game, it's important to stay informed, diversify your portfolio, and adjust your strategy as needed. Whether you're a long-term investor or a short-term trader, there are opportunities to be had in today's market. So, take a deep breath, do your research, and get ready to ride the wave!

And don't forget to share your thoughts in the comments below. What's your take on the current market rally? Are you bullish or bearish? Let's keep the conversation going!

Table of Contents

- What's Driving the Market Rally?

- Why Is the Nasdaq So Important?

- Key Players in the Nasdaq

- How the Fed Rate Decision Affects the Market

- What to Watch For

- Investor Sentiment and Market Psychology

- How to Gauge Investor Sentiment

- Strategies for Capitalizing on the Market Rally

- Long-Term vs. Short-Term Strategies

- Risks and Challenges in Today's Market

- How to Mitigate Risks

- Conclusion: What's Next for the Stock Market?

As Musk’s Business Empire Falters, Trump Summons A Wave Of Conservative Support

Conservatives' Tesla Rescue Mission Has Its Work Cut Out

How To Watch The First NCAA March Madness Games: Your Ultimate Fan Guide

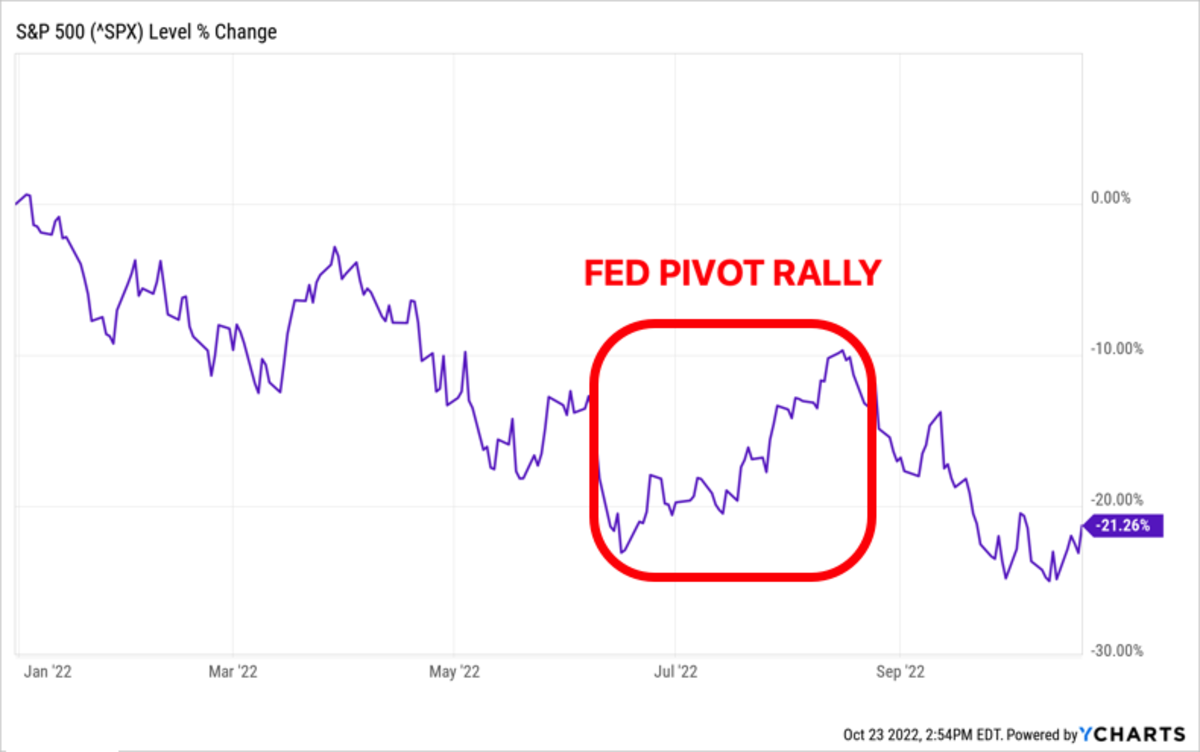

The Fed Pivot Is A Myth, But The Markets Might Rally Anyway ETF Focus

Investors Should Cheer A Higher Federal Funds Rate (NYSEARCASPY

Nvidia Tops 2 Trillion as S&P 500 and Nasdaq Hit Fresh Highs Stock