Tax Day 2025: The Ultimate Guide To Navigating Your Finances

Hey there, tax warrior! If you’re reading this, chances are you’re already thinking about Tax Day 2025—and trust me, you’re not alone. Tax Day is one of those dates that sends shivers down the spine of every taxpayer, but it doesn’t have to be a nightmare. In fact, with the right preparation and a bit of know-how, you can turn Tax Day into an opportunity to take control of your finances. So, buckle up and let’s dive into everything you need to know about Tax Day 2025.

Tax Day isn’t just a random date on the calendar; it’s a deadline that can make or break your financial year. Whether you’re a seasoned pro at filing taxes or a newbie who’s still figuring out the difference between a W-2 and a 1099, this guide is here to help. We’re breaking it all down for you—no complicated jargon, just straightforward advice to make sure you’re ready for April 15, 2025.

Now, before we get into the nitty-gritty, let’s talk about why Tax Day 2025 is so important. The IRS isn’t playing games, and missing the deadline can lead to penalties, interest charges, and a whole lot of stress. But don’t worry—we’ve got your back. This article is packed with tips, tricks, and expert advice to help you navigate the tax season like a pro. Let’s get started!

What Exactly is Tax Day 2025?

Tax Day 2025 refers to the annual deadline set by the IRS for individuals and businesses to file their federal income tax returns. Typically, Tax Day falls on April 15th, but if that date lands on a weekend or holiday, it might be pushed to the next business day. In 2025, Tax Day is scheduled for April 15th, so mark your calendars now!

But what makes Tax Day so significant? Well, it’s the day when Uncle Sam wants his share of your hard-earned money. Failing to file or pay your taxes on time can result in hefty fines and penalties, which is why it’s crucial to stay on top of your tax obligations. And let’s not forget, Tax Day isn’t just about paying what you owe—it’s also your chance to claim refunds for overpaid taxes.

Why Should You Care About Tax Day 2025?

Ignoring Tax Day is like ignoring a speeding ticket—it’ll only get worse the longer you put it off. Whether you owe money to the IRS or are expecting a refund, staying informed and prepared is key. Here are a few reasons why Tax Day 2025 matters:

- Financial Responsibility: Paying your taxes on time is a sign of financial maturity and responsibility. It shows that you’re taking control of your financial future.

- Avoiding Penalties: The IRS doesn’t mess around when it comes to late filings. By missing the deadline, you could face penalties of up to 5% of the unpaid taxes per month, plus interest.

- Maximizing Refunds: If you’ve overpaid your taxes throughout the year, Tax Day is your chance to get that money back. Why leave free money on the table?

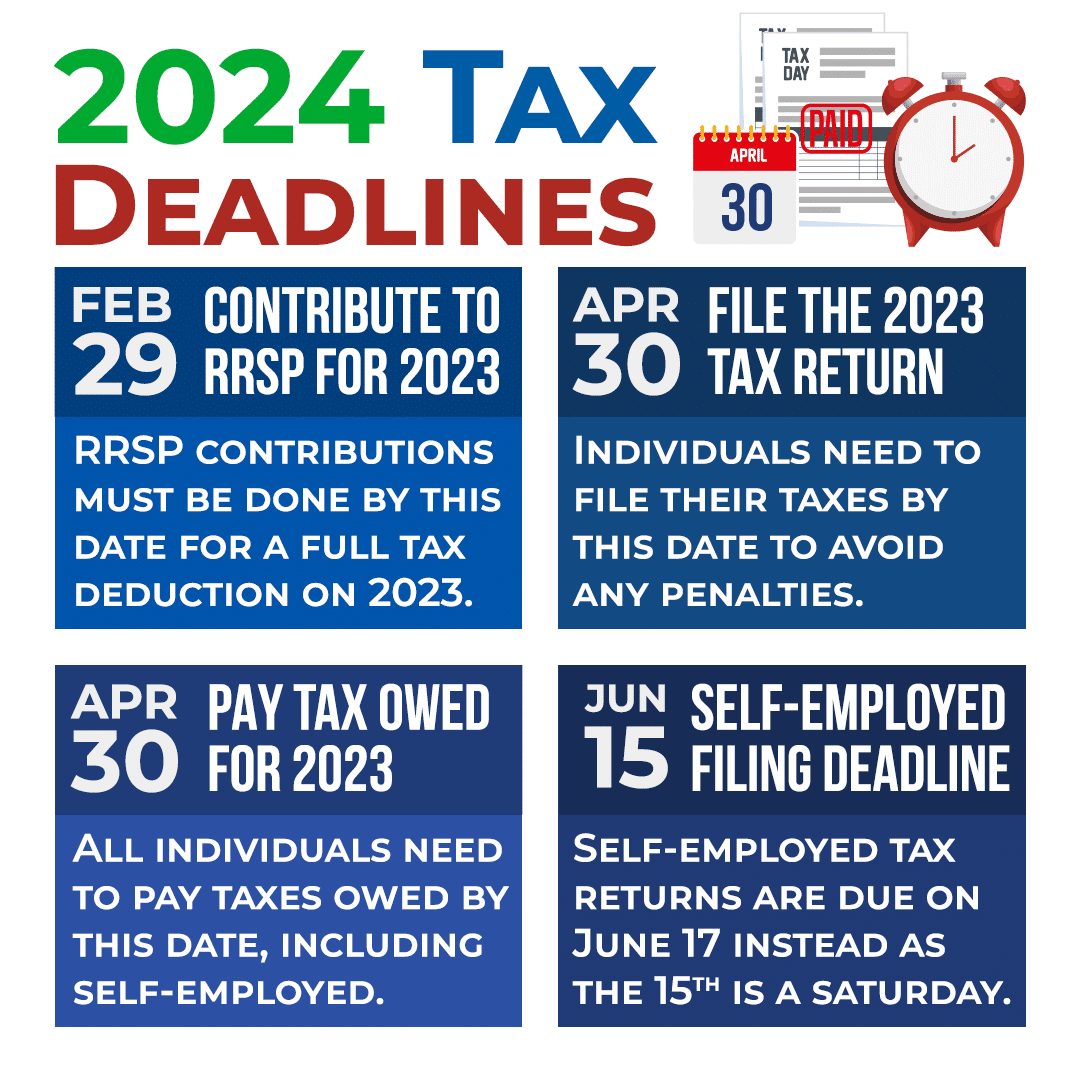

Key Dates and Deadlines for Tax Day 2025

Knowing the key dates and deadlines for Tax Day 2025 is essential for staying organized. Here’s a quick rundown of what you need to keep in mind:

Important Deadlines to Remember

- January 31st, 2025: Employers must send out W-2 forms to employees. If you’re self-employed, keep an eye out for your 1099 forms.

- March 1st, 2025: Start gathering all your financial documents, including receipts, invoices, and bank statements. The more organized you are, the smoother the filing process will be.

- April 15th, 2025: This is the big day—Tax Day! Make sure your tax return is filed and any owed taxes are paid by this date.

Pro Tip: Don’t wait until the last minute. Start preparing your documents and filing early to avoid last-minute stress.

How to Prepare for Tax Day 2025

Preparation is the name of the game when it comes to Tax Day. Here’s a step-by-step guide to help you get ready:

Gather All Necessary Documents

Before you start filing, make sure you have all the necessary documents in hand:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements for interest and dividend income

Choose the Right Filing Method

There are several ways to file your taxes, and the method you choose can depend on your comfort level and the complexity of your financial situation:

- Online Filing: E-file is the fastest and most secure way to submit your tax return. Plus, you’ll get your refund faster if you opt for direct deposit.

- Paper Filing: If you prefer the old-school way, you can still file a paper return. Just make sure to mail it in plenty of time to meet the deadline.

Common Mistakes to Avoid on Tax Day 2025

Mistakes happen, but when it comes to taxes, even small errors can have big consequences. Here are some common pitfalls to watch out for:

- Missing Deadlines: Don’t wait until April 14th to start filing. Give yourself plenty of time to avoid rushing and making mistakes.

- Incorrect Social Security Numbers: Double-check that all SSNs on your forms are correct. A single typo can delay your refund or trigger an audit.

- Forgetting Deductions: Many taxpayers leave money on the table by not claiming all the deductions they’re entitled to. Do your research or consult a tax professional.

Tax Deductions and Credits for 2025

One of the best ways to reduce your tax liability is by taking advantage of deductions and credits. Here are a few to keep in mind:

Popular Deductions

- Standard Deduction: Most taxpayers can claim the standard deduction, which is $13,850 for single filers and $27,700 for married couples filing jointly in 2025.

- Itemized Deductions: If your expenses exceed the standard deduction, you might benefit from itemizing. Common itemized deductions include mortgage interest, charitable contributions, and medical expenses.

Key Tax Credits

- Child Tax Credit: If you have qualifying dependents, you might be eligible for a credit of up to $2,000 per child.

- Earned Income Tax Credit (EITC): This credit is designed to help low- to moderate-income taxpayers and can result in a significant refund.

Understanding Tax Brackets for 2025

Tax brackets determine how much you’ll owe based on your income. Here’s a quick look at the federal income tax brackets for 2025:

| Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 |

| 12% | $11,001 to $44,725 | $22,001 to $89,450 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 |

Remember, your tax bracket doesn’t determine your overall tax rate—it only affects the portion of your income that falls within that bracket.

How to File for an Extension on Tax Day 2025

If you’re not ready to file by April 15th, don’t panic! You can request an automatic six-month extension by filing Form 4868 with the IRS. Keep in mind that while an extension gives you more time to file, it doesn’t extend the deadline for paying any taxes you owe. If you expect to owe money, make an estimated payment by April 15th to avoid penalties.

Tools and Resources for Tax Day 2025

There’s no shortage of tools and resources to help you navigate Tax Day. Here are a few worth checking out:

- TurboTax: A user-friendly software that walks you through the filing process step by step.

- IRS Website: The official IRS site offers a wealth of information, including forms, calculators, and FAQs.

- Tax Professionals: If your taxes are complex or you’re feeling overwhelmed, consider hiring a certified public accountant (CPA) or enrolled agent (EA).

Final Thoughts and Call to Action

There you have it—everything you need to know about Tax Day 2025. By staying organized, taking advantage of deductions and credits, and filing on time, you can make Tax Day a breeze. Remember, preparation is key, so start gathering your documents and setting aside time to tackle your taxes well before the deadline.

Now it’s your turn! Did you find this guide helpful? Have any questions or tips of your own? Drop a comment below and let us know. And don’t forget to share this article with your friends and family so they can get ready for Tax Day too. Together, we can conquer tax season and take control of our finances!

Table of Contents

- What Exactly is Tax Day 2025?

- Why Should You Care About Tax Day 2025?

- Key Dates and Deadlines for Tax Day 2025

- How to Prepare for Tax Day 2025

- Common Mistakes to Avoid on Tax Day 2025

- Tax Deductions and Credits for 2025

- Understanding Tax Brackets for 2025

- How to File for an Extension on Tax Day 2025

- Tools and Resources for Tax Day 2025

- Final Thoughts and Call to Action

Pacers Vs Nets: The Ultimate Showdown In The NBA Arena

Why Portugal Soccer Is A Global Phenomenon You Can't Ignore

Italy FC: The Heart And Soul Of European Football

Tax Day 2025 News Articles Isaac Gray

Tax Deadline 2025 Los Angeles Sarah T Maygar

Tax Deadline 2025 Canada Adam Johnston