Student Loans: A Comprehensive Guide To Understanding, Managing, And Repaying

Let’s face it, folks—student loans are a massive part of life for millions of students and graduates across the globe. Whether you’re just starting college or already knee-deep in repayments, understanding how student loans work is crucial. This ain’t no small potatoes; we’re talking about your financial future here. So, buckle up because we’re about to dive deep into the world of student loans—how they work, what you need to know, and how to manage them without losing your mind.

Now, I know what you’re thinking: "Student loans sound like a headache waiting to happen." And sure, they can be tricky, but with the right info, you can navigate this whole mess like a pro. Think of it as an investment in your future—a future where you can pay off those loans and still have some cash left over for that dream vacation or a new car. Wouldn’t that be nice?

But before we get into all the nitty-gritty details, let’s just take a moment to acknowledge the elephant in the room. Student loans are not just numbers on a piece of paper; they’re real-life obligations that can affect your credit score, your monthly budget, and even your long-term financial goals. So, it’s super important to understand them inside out. And that’s exactly what we’re going to do here.

What Are Student Loans Anyway?

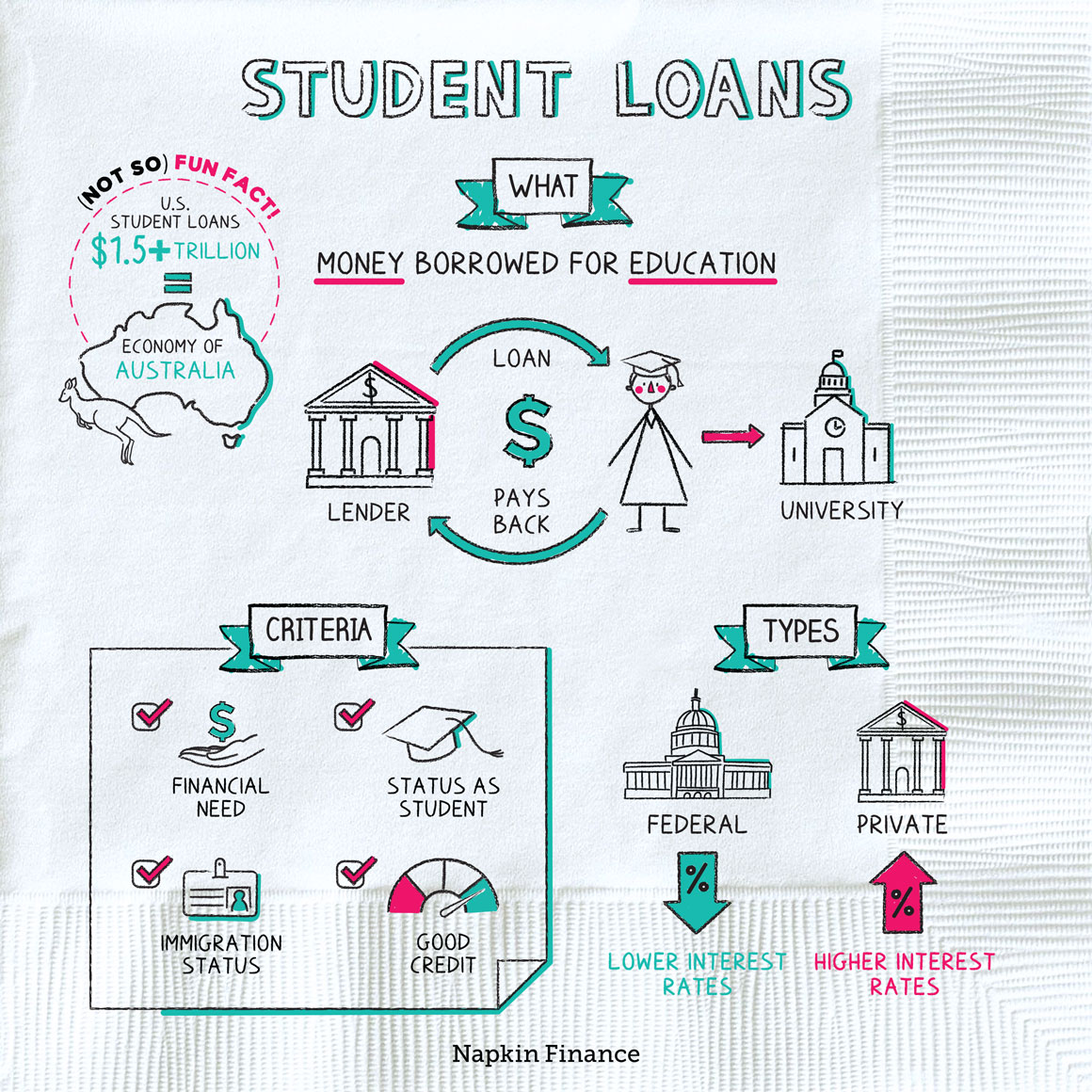

Alrighty, let’s start with the basics. A student loan is essentially a financial agreement between you and a lender—usually the government or a private institution. You borrow money to pay for your education, and in return, you promise to pay it back (with interest) after you graduate or leave school. Sounds simple enough, right? Well, not exactly.

There are different types of student loans, each with its own set of rules and regulations. Some loans come with lower interest rates, while others might have stricter repayment terms. It’s like choosing between a cupcake and a donut—both are sweet, but one might give you a sugar rush you’re not ready for.

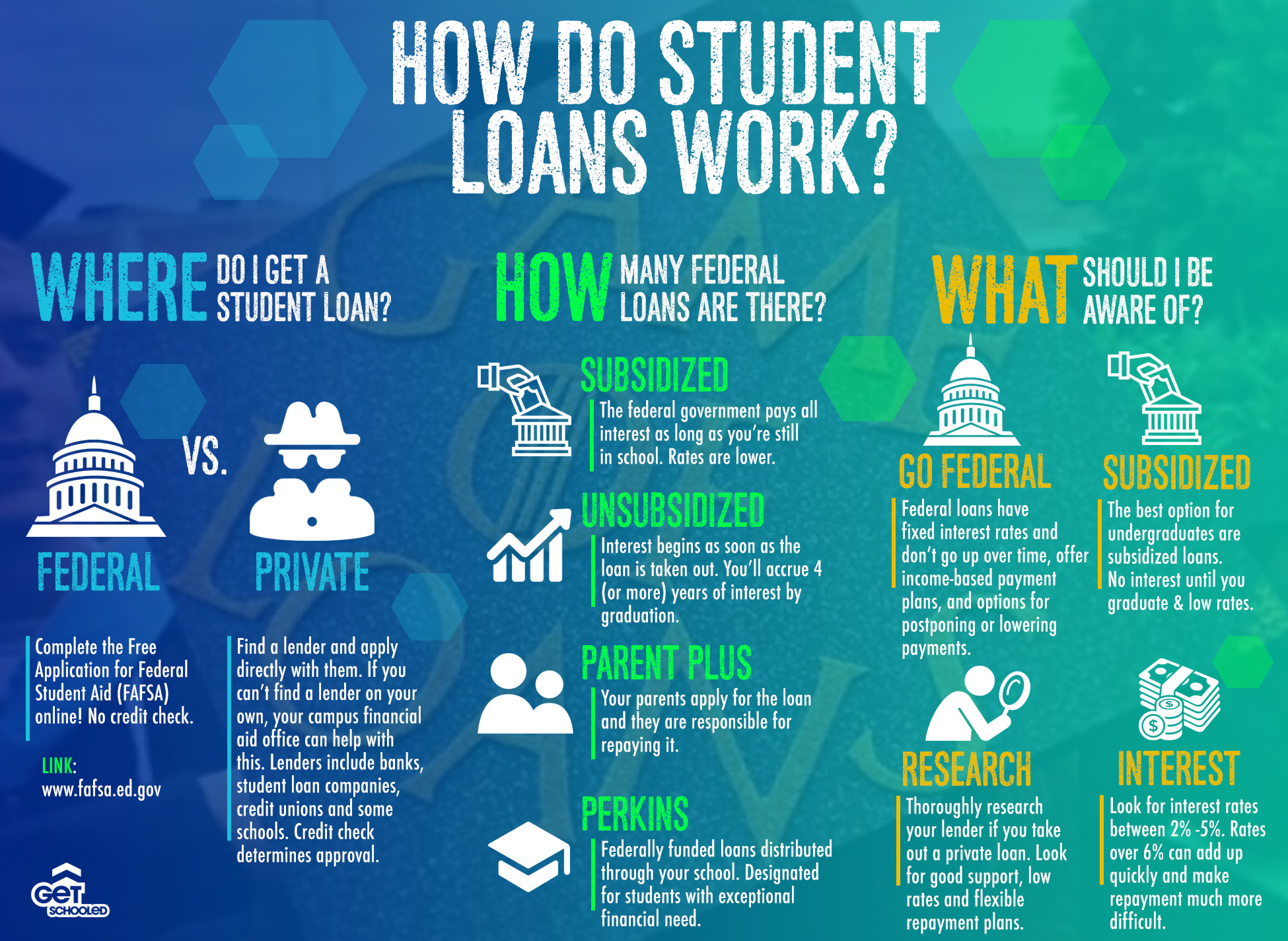

Types of Student Loans

Now, let’s break it down even further. There are mainly two types of student loans: federal and private. Federal loans are offered by the government and usually come with more favorable terms, like fixed interest rates and income-driven repayment plans. Private loans, on the other hand, are offered by banks or financial institutions and might have higher interest rates and less flexibility.

- Federal Loans: These include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. They’re usually the go-to option for most students because of their lower interest rates and better repayment options.

- Private Loans: These are offered by banks, credit unions, and online lenders. While they might seem appealing at first, they often come with higher interest rates and fewer borrower protections.

Why Are Student Loans Important?

Here’s the deal: student loans are important because they provide access to education for people who might not otherwise be able to afford it. Without them, a lot of students would be stuck working full-time jobs just to pay for tuition, which could delay their graduation or even force them to drop out. And nobody wants that.

But here’s the kicker: student loans also come with responsibilities. You’ve got to be smart about how much you borrow and how you plan to pay it back. It’s like buying a car—you don’t want to get stuck with something you can’t afford. So, it’s crucial to understand the terms of your loan and make a plan to pay it off as soon as possible.

Key Statistics on Student Loans

Let’s talk numbers for a sec. According to recent data, the total amount of student loan debt in the U.S. is over $1.7 trillion. That’s a lot of zeros, folks! And it’s not just limited to the States; countries like the UK, Canada, and Australia also have significant student loan debt.

- As of 2023, the average student loan debt for a bachelor’s degree in the U.S. is around $37,000.

- About 45 million borrowers in the U.S. collectively owe over $1.7 trillion in student loan debt.

- Student loan default rates have been on the rise, with about 11% of borrowers defaulting within three years of entering repayment.

How to Apply for Student Loans

So, you’ve decided to take out a student loan. Great! But where do you start? The first step is to fill out the Free Application for Federal Student Aid (FAFSA). This form determines your eligibility for federal student aid, including grants, work-study, and loans.

Once you’ve completed the FAFSA, you’ll receive a Student Aid Report (SAR) that outlines the types and amounts of financial aid you’re eligible for. From there, you can decide which loans to accept and how much to borrow. Just remember, only borrow what you need—no need to max out that loan just because you can.

Tips for Applying for Student Loans

- Submit your FAFSA as early as possible to maximize your chances of receiving financial aid.

- Read the fine print carefully before accepting any loan offers.

- Consider your future earning potential when deciding how much to borrow.

Understanding Interest Rates

Interest rates are one of the most important factors to consider when taking out a student loan. They determine how much extra you’ll end up paying over the life of the loan. Federal loans typically have fixed interest rates, which means the rate stays the same throughout the life of the loan. Private loans, however, might have variable interest rates, which can fluctuate over time.

For example, let’s say you borrow $20,000 at a 5% interest rate. Over the course of 10 years, you’ll end up paying around $5,500 in interest alone. That’s a lot of money, folks! So, it’s essential to understand how interest rates work and how they’ll affect your repayment plan.

How to Compare Interest Rates

When comparing student loans, don’t just look at the interest rate. Consider the loan terms, repayment options, and any fees associated with the loan. Some loans might have lower interest rates but come with higher fees or stricter repayment terms. It’s like comparing apples to oranges—both are fruit, but they’re not the same.

Repayment Plans: What You Need to Know

Once you’ve graduated or left school, it’s time to start thinking about repayment. The good news is, there are several repayment plans available to help make your monthly payments more manageable. Standard repayment plans usually last 10 years, but there are also income-driven repayment plans that adjust your monthly payments based on your income.

For example, the Income-Based Repayment (IBR) plan caps your monthly payments at 10-15% of your discretionary income. This can be a lifesaver for borrowers who are struggling to make ends meet. Just keep in mind that income-driven plans might extend the life of your loan, which means you’ll end up paying more in interest over time.

Options for Repayment Assistance

- Loan consolidation: This allows you to combine multiple loans into one, making it easier to manage your payments.

- Loan forgiveness programs: Certain professions, like teaching or public service, may qualify for loan forgiveness after a certain number of years.

- Deferment or forbearance: If you’re struggling to make payments, you might be able to temporarily pause or reduce your payments.

Managing Student Loan Debt

Managing student loan debt can be a challenge, but it’s not impossible. The key is to create a budget and stick to it. Start by listing all your monthly expenses and prioritizing your loan payments. If you have extra cash, consider making additional payments to reduce your principal balance and save on interest.

It’s also important to stay informed about any changes in loan terms or repayment options. Lenders might offer discounts for automatic payments or interest rate reductions for good credit scores. Keep an eye out for these opportunities to save money and make your repayments easier.

Strategies for Paying Off Student Loans Faster

- Make extra payments whenever possible.

- Consider refinancing your loans for a lower interest rate.

- Take advantage of employer-sponsored student loan repayment programs.

The Impact of Student Loans on Credit Scores

Student loans can have a significant impact on your credit score, both positive and negative. If you make your payments on time, it can help build a strong credit history. But if you miss payments or default on your loan, it can damage your credit score and make it harder to get loans or credit cards in the future.

That’s why it’s so important to stay on top of your payments and communicate with your lender if you’re having trouble. They might be able to offer you options like deferment or forbearance to help you get back on track.

How to Improve Your Credit Score

If your credit score has taken a hit because of student loans, don’t worry—there are ways to improve it. Start by paying your bills on time and keeping your credit utilization low. You can also dispute any errors on your credit report and consider adding positive financial behaviors, like paying off other debts or opening a secured credit card.

Conclusion: Taking Control of Your Student Loan Journey

Alrighty, folks, that’s the scoop on student loans. They might seem intimidating at first, but with the right info and a solid plan, you can navigate them like a pro. Remember, student loans are an investment in your future, so it’s worth taking the time to understand them and manage them wisely.

So, what’s next? Take a deep breath, review your options, and make a plan. Whether you’re just starting out or already in repayment, there are resources and strategies available to help you succeed. And don’t forget to share this article with your friends and family—knowledge is power, after all.

Oh, and one last thing: if you’ve got any questions or comments, drop them below. We’d love to hear from you and help you on your student loan journey. Stay cool, and keep crushing those goals!

Table of Contents

- What Are Student Loans Anyway?

- Types of Student Loans

- Why Are Student Loans Important?

- Key Statistics on Student Loans

- How to Apply for Student Loans

- Tips for Applying for Student Loans

- Understanding Interest Rates

- How to Compare Interest Rates

- Repayment Plans: What You Need to Know

- Options for Repayment Assistance

- Managing Student Loan Debt

- Strategies for Paying Off Student Loans Faster

- The Impact of Student Loans on Credit Scores

- How to Improve Your Credit Score

- Conclusion: Taking Control of Your Student Loan Journey

Where To Watch Nations League: Your Ultimate Guide To Catching The Action

Eddie Jordan F1: The Man Who Shaped Formula 1 Racing

Trendon Watford: The Rising Star Shaping The NBA's Future

Federal Student Loans Navigating the System

Napkin Finance explains Federal Student Loans and Private Student Loans

Where to Get a Student Loan for Bad Credit in Canada Finder