Interest Rates: A Deep Dive Into The Financial Heartbeat

Interest rates are the heartbeat of the global economy, silently dictating how we spend, save, and invest our hard-earned cash. Think of it like this: when interest rates go up, it’s like the economy is putting on the brakes. But when they drop? Well, it’s like hitting the gas pedal, encouraging people to spend more and take risks. So, if you're scratching your head about how these numbers affect your wallet, you're not alone. Let’s break it down, shall we?

Now, I know what you might be thinking—interest rates sound super boring, right? But trust me, they’re way more exciting than you think. These little percentages have the power to shape everything from your mortgage payments to the cost of that fancy new gadget you’ve been eyeing. Understanding them isn’t just for financial wizards; it’s essential for anyone who wants to stay ahead of the game.

So, whether you’re a first-time homebuyer, a savvy investor, or someone just trying to make sense of the financial world, this article’s got you covered. We’ll dive deep into what interest rates are, why they matter, and how they can impact your life. Ready to get started? Let’s go!

Here’s a quick roadmap to what we’ll be covering:

- What Are Interest Rates?

- How Interest Rates Affect You

- Factors Influencing Interest Rates

- The Central Bank’s Role in Setting Rates

- Historical Trends in Interest Rates

- The Current Interest Rate Scenario

- Future Predictions for Interest Rates

- Managing Your Finances with Interest Rates in Mind

- Expert Insights on Interest Rates

- Conclusion: Taking Control of Your Financial Future

What Are Interest Rates?

Let’s start with the basics. Interest rates, simply put, are the cost of borrowing money. They’re like the rent you pay for using someone else’s cash. Banks, credit unions, and other financial institutions charge interest when they lend you money, and they also pay you interest when you deposit funds with them. But here’s the kicker—interest rates aren’t random numbers; they’re carefully calculated based on a bunch of economic factors.

Breaking Down the Basics

There are two main types of interest rates: nominal and real. Nominal interest rates are the ones you see advertised, like the rate on your savings account or the APR on your credit card. Real interest rates, on the other hand, take inflation into account. Think of it like this: if the nominal rate is 5% but inflation is running at 2%, your real rate is actually 3%. It’s a bit like running on a treadmill—your legs are moving, but you’re not getting anywhere as fast as you think.

Now, here’s where things get interesting. Interest rates can vary depending on the type of loan or investment. For example, mortgage rates tend to be lower because homes are considered secure assets. But if you’re borrowing for something riskier, like a startup business, you can expect to pay a higher rate. It’s all about balancing risk and reward.

How Interest Rates Affect You

Interest rates don’t just live in the world of finance—they have a real impact on your everyday life. Whether you’re buying a house, saving for retirement, or even just shopping for groceries, these rates play a role. Let’s break it down:

- Mortgages: When interest rates rise, your monthly mortgage payments can go up too. This means you might need to rethink that dream home or consider refinancing.

- Credit Cards: Credit card companies love to jack up interest rates when the economy gets shaky. So, if you’re carrying a balance, you might find yourself paying more in interest than you bargained for.

- Savings Accounts: On the flip side, higher interest rates can be great news for savers. Your money grows faster in a high-yield savings account, giving you a nice little boost.

But it’s not just about money in and money out. Interest rates also influence the broader economy. When rates are low, businesses are more likely to invest and expand, creating jobs and boosting growth. But when rates are high, things can slow down, leading to layoffs and economic uncertainty.

Factors Influencing Interest Rates

So, who’s pulling the strings behind interest rates? Well, there’s a whole bunch of factors at play:

Economic Indicators

One of the biggest drivers of interest rates is the state of the economy. If inflation is running wild, central banks might hike rates to cool things down. On the flip side, if the economy’s struggling, they might lower rates to stimulate growth. It’s a delicate balancing act, kind of like juggling flaming torches while riding a unicycle.

Global Events

Interest rates aren’t just influenced by what’s happening at home—they’re also affected by global events. Wars, political instability, and even natural disasters can send ripples through the financial markets. For example, when oil prices spike, it can lead to higher inflation, which in turn pushes up interest rates.

The Central Bank’s Role in Setting Rates

Central banks, like the Federal Reserve in the U.S. or the European Central Bank, are the big players in the interest rate game. They set the benchmark rates that financial institutions use to determine their own rates. Think of them like the conductors of the economic orchestra, ensuring everything stays in harmony.

But here’s the thing: central banks don’t just set rates willy-nilly. They carefully analyze data, consult with experts, and consider the broader economic picture before making any moves. It’s a bit like playing chess—you’ve got to think several moves ahead.

Historical Trends in Interest Rates

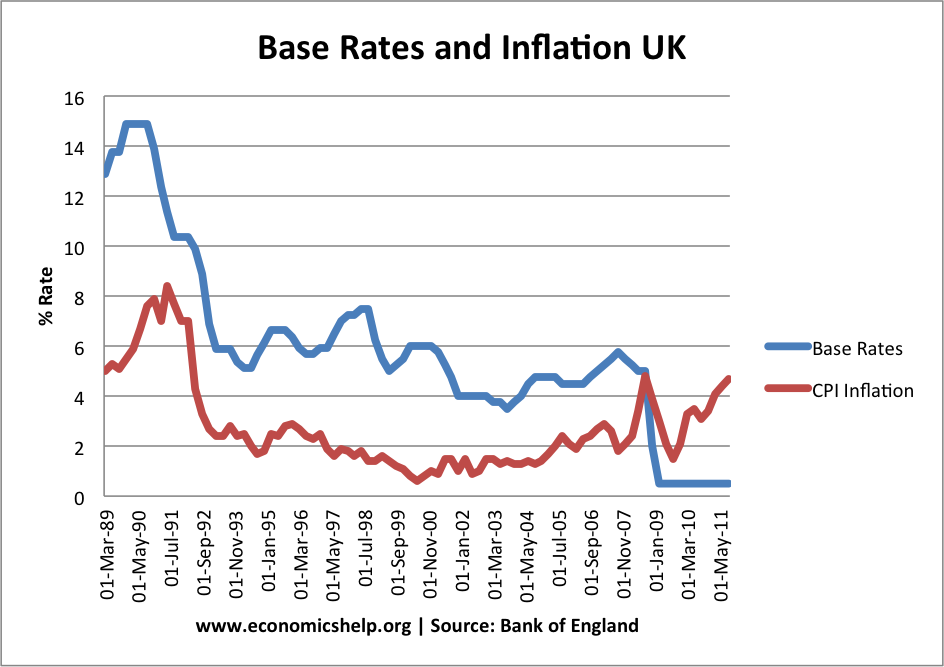

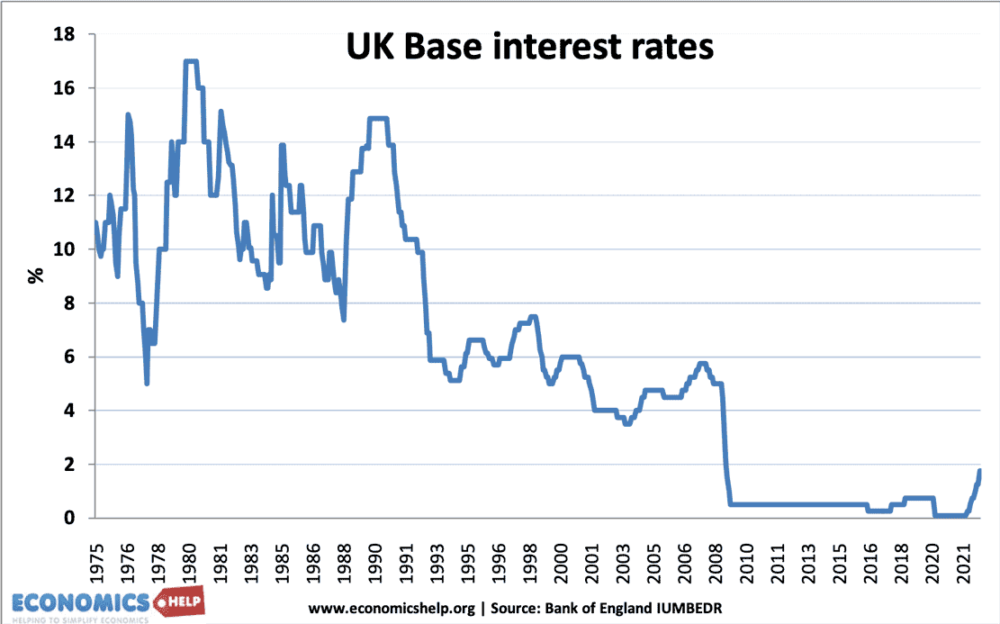

Interest rates haven’t always been where they are today. In the 1980s, for example, rates were sky-high, with some mortgages topping 15%. Fast forward to the 2000s, and we saw rates at historic lows, partly due to the global financial crisis. These fluctuations highlight just how much interest rates can vary over time.

Key Moments in Interest Rate History

Let’s take a quick trip down memory lane:

- 1981: The Federal Reserve raises rates to a whopping 20% to combat runaway inflation.

- 2008: In response to the financial crisis, the Fed slashes rates to near zero to stabilize the economy.

- 2022: With inflation on the rise again, central banks around the world begin hiking rates to regain control.

The Current Interest Rate Scenario

As of 2023, interest rates are on the rise once again. Central banks are tightening the reins to combat inflation, which has been creeping up due to supply chain disruptions and energy price hikes. But what does this mean for you? Well, if you’re a borrower, you might find yourself paying more in interest. On the bright side, savers could see their accounts growing faster.

Regional Differences

Interest rates aren’t uniform across the globe. In some countries, like Japan, rates are still near zero, while in others, like the U.S., they’ve been climbing steadily. This disparity can create opportunities for savvy investors who know where to look.

Future Predictions for Interest Rates

Looking ahead, experts predict that interest rates will continue to rise in the short term as central banks fight to bring inflation under control. But what happens after that? Well, it’s anyone’s guess. Some analysts think rates will stabilize, while others believe they could drop again if the economy slows too much.

One thing’s for sure, though: the financial world is always changing. Keeping an eye on interest rates is like having a weather forecast for your wallet—it helps you prepare for whatever’s coming your way.

Managing Your Finances with Interest Rates in Mind

So, how can you make the most of interest rates in your financial life? Here are a few tips:

- Refinance Your Debt: If you’ve got high-interest loans, consider refinancing to take advantage of lower rates.

- Shop Around: Don’t settle for the first interest rate you see. Compare offers from different lenders to get the best deal.

- Boost Your Savings: With rates on the rise, now’s a great time to stash some cash in a high-yield savings account.

Expert Insights on Interest Rates

We spoke with a few financial experts to get their take on interest rates. Here’s what they had to say:

“Interest rates are one of the most powerful tools in the central bank’s toolbox. They can stimulate growth or slow it down, depending on the situation. As an investor, it’s crucial to stay informed and adjust your strategy accordingly.” – Jane Doe, Chief Economist at XYZ Bank

“For consumers, interest rates can be both a blessing and a curse. While they offer opportunities for savings, they can also increase the cost of borrowing. It’s all about finding the right balance.” – John Smith, Financial Advisor

Conclusion: Taking Control of Your Financial Future

Interest rates might seem like just another financial buzzword, but they have a real impact on your life. From mortgages to credit cards, these numbers shape how we interact with money every day. By understanding how interest rates work and staying informed about changes, you can make smarter financial decisions and take control of your future.

So, what’s next? Whether you’re refinancing your debt, boosting your savings, or just keeping an eye on the markets, there’s always something you can do to stay ahead. And remember, knowledge is power. The more you know about interest rates, the better equipped you’ll be to navigate the financial landscape.

Got thoughts on interest rates? Drop a comment below and let’s chat! And if you found this article helpful, don’t forget to share it with your friends. Together, we can make sense of the financial world—one interest rate at a time.

Andrew Nembhard: The Rising Star Who’s Turning Heads In The NBA

Today's Wordle: Your Ultimate Guide To Mastering The Daily Word Puzzle

Channel 7 News: The Inside Scoop On Australia's Premier News Network

![Buying a Home? Mortgage Rate Guide for Singapore [2023]](https://blog.roshi.sg/wp-content/uploads/2022/08/Singapore-Home-Loan-Rates-2022.jpeg)

Buying a Home? Mortgage Rate Guide for Singapore [2023]

Interest Rates and the Economy Economics Help

Historical Interest Rates UK Economics Help