FOMC Meeting Time: Your Ultimate Guide To Understanding The Fed's Key Schedule

Ever wondered when the Federal Reserve's bigwigs get together to decide the fate of the U.S. economy? Well, buckle up, because we're diving deep into FOMC meeting time and everything you need to know about it! If you're into finance, trading, or just trying to make sense of the economic world, the Federal Open Market Committee (FOMC) meetings are a big deal. These meetings shape monetary policy, influence interest rates, and can send ripples through global markets. But when exactly do these meetings happen? That’s what we’re here to break down for you.

Now, you might be thinking, "Why should I care about FOMC meeting time?" Well, my friend, whether you're an investor, a business owner, or even just someone keeping an eye on their savings account, these meetings matter. They can affect everything from mortgage rates to stock prices. So, yeah, it's worth paying attention.

Before we dive deeper, let me just say this: the FOMC meeting schedule isn’t random. There’s a method to the madness, and understanding it can give you a leg up in navigating the financial landscape. Stick around, and we’ll unpack it all for you. No financial jargon overload, just straight talk about what’s going on behind the scenes.

What is the FOMC and Why Should You Care?

First things first, let’s get clear on what the FOMC actually is. The Federal Open Market Committee, or FOMC for short, is the brain trust of the Federal Reserve System. It’s the group responsible for setting monetary policy in the U.S. Think of them as the economic strategists who decide how much gas to give the economy—or when to hit the brakes.

Here’s the deal: the FOMC has eight scheduled meetings a year, and these meetings are where they discuss and decide on things like interest rates, bond purchases, and other monetary policies. These decisions can have a massive impact on the economy, so if you're into stocks, bonds, or just trying to figure out if it's a good time to buy a house, you’ll want to keep an eye on these meetings.

Now, why should you care? Because the FOMC’s decisions can affect everything from inflation to unemployment rates. If they raise interest rates, borrowing money gets more expensive, which can slow down the economy. If they lower rates, borrowing becomes cheaper, which can stimulate growth. It’s like the FOMC is the conductor of the economic orchestra, and their meetings are where they set the tempo.

Who Makes Up the FOMC?

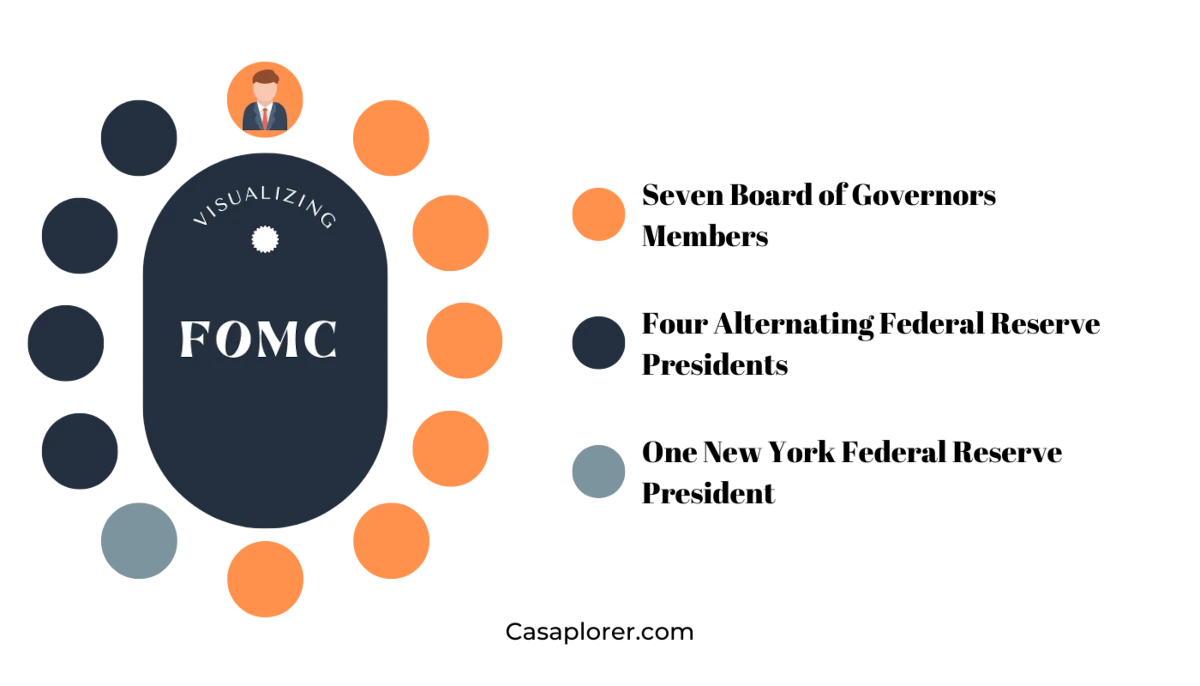

Alright, so who’s in charge here? The FOMC is made up of twelve members. Seven of them are the Board of Governors of the Federal Reserve System, and the other five are Federal Reserve Bank presidents. These aren’t just any people—they’re some of the top economic minds in the country.

Here’s a quick rundown of the key players:

- Jerome Powell: The current Chair of the Federal Reserve, he’s the guy calling the shots.

- Lael Brainard: A prominent member of the Board of Governors, known for her expertise in international finance.

- John Williams: President of the Federal Reserve Bank of New York, one of the most influential voices on the committee.

These folks, along with the rest of the committee, meet regularly to assess the state of the economy and make decisions that affect all of us. So, yeah, they’re kind of a big deal.

FOMC Meeting Time: The Schedule You Need to Know

Alright, now let’s talk about the meat and potatoes of this whole thing: the FOMC meeting time. The committee meets eight times a year, and these meetings are spaced out pretty evenly throughout the calendar. They usually last for two days, and they’re held in Washington, D.C.

Here’s the general schedule:

- January: Typically the first meeting of the year, usually held in late January.

- March: The second meeting, often featuring a press conference afterward.

- May: The third meeting, usually in early May.

- June: The fourth meeting, another one with a press conference.

- July: The fifth meeting, usually in late July.

- September: The sixth meeting, often featuring updated economic projections.

- November: The seventh meeting, usually in early November.

- December: The final meeting of the year, often the most anticipated one.

Now, keep in mind that these dates can shift slightly from year to year, but this is the general rhythm of the FOMC meeting schedule. If you’re a trader or investor, marking these dates on your calendar is a good idea. These meetings can cause some serious market volatility, so being prepared is key.

What Happens During an FOMC Meeting?

So, what exactly goes down during these meetings? Well, the FOMC spends a lot of time reviewing economic data, discussing current trends, and debating the best course of action. They look at things like unemployment rates, inflation, GDP growth, and more. Then, they decide whether to raise, lower, or keep interest rates the same.

Here’s a quick breakdown of the typical FOMC meeting agenda:

- Day 1: Members review economic data and discuss current trends.

- Day 2: They debate policy options and vote on any changes to monetary policy.

After the meeting, they release a statement summarizing their decisions and rationale. If it’s a meeting with a press conference, the Chair of the Federal Reserve will hold a Q&A session to explain their decisions in more detail. It’s like a behind-the-scenes look at how the Fed is steering the economic ship.

How Do FOMC Meetings Affect the Market?

Alright, let’s talk about the elephant in the room: how do FOMC meetings impact the market? The short answer is, they can have a huge impact. When the FOMC announces changes to interest rates or other monetary policies, it can send shockwaves through the financial world.

Here’s how it typically plays out:

- Interest Rates: If the FOMC raises interest rates, borrowing costs go up, which can slow down economic growth. This can lead to a sell-off in the stock market as investors anticipate lower corporate profits.

- Bond Prices: Higher interest rates also mean lower bond prices, so fixed-income investors might see some losses.

- Currency Value: A stronger dollar is often a side effect of higher interest rates, as foreign investors seek higher returns on U.S. assets.

On the flip side, if the FOMC lowers interest rates, borrowing becomes cheaper, which can stimulate economic growth. This can lead to a rally in the stock market as investors anticipate higher corporate profits. It’s like a game of economic chess, and the FOMC’s moves can determine the next big market moves.

Key Indicators to Watch During FOMC Meetings

So, what should you be keeping an eye on during FOMC meetings? Here are a few key indicators:

- Inflation Data: The FOMC closely monitors inflation, so any changes in inflation trends can influence their decisions.

- Employment Numbers: Unemployment rates are another big factor. If job growth is strong, the FOMC might be more inclined to raise rates.

- GDP Growth: A strong GDP growth rate can signal a healthy economy, which might lead to tighter monetary policy.

By keeping an eye on these indicators, you can get a better sense of what the FOMC might do at their next meeting. It’s like being a financial detective, piecing together clues to predict the Fed’s next move.

Historical Impact of FOMC Decisions

Now, let’s take a trip down memory lane and look at some of the most impactful FOMC decisions in recent history. These moments have shaped the economic landscape and left lasting impressions on the financial world.

Here are a few standout moments:

- 2008 Financial Crisis: In response to the global financial meltdown, the FOMC slashed interest rates to near zero and launched massive bond-buying programs to stabilize the economy.

- 2015 Rate Hike: After years of near-zero rates, the FOMC finally raised interest rates in December 2015, signaling a return to more normal monetary policy.

- 2020 Pandemic Response: When the pandemic hit, the FOMC acted swiftly, cutting rates to zero and implementing unprecedented stimulus measures to support the economy.

These moments show just how powerful the FOMC’s decisions can be. They have the ability to steer the economy through rough waters and set the stage for future growth. It’s like they’re the economic equivalent of a superhero team, ready to save the day when things get tough.

Lessons Learned from Past FOMC Actions

So, what can we learn from these historical moments? A few key takeaways:

- Monetary Policy Matters: The FOMC’s decisions can have far-reaching effects on the economy, so paying attention to their meetings is crucial.

- Flexibility is Key: The FOMC has shown a willingness to adapt its policies in response to changing economic conditions, whether it’s a financial crisis or a global pandemic.

- Communication is Essential: Clear communication from the FOMC can help manage market expectations and reduce uncertainty.

These lessons highlight the importance of staying informed and understanding the FOMC’s role in shaping the economic landscape. It’s not just about the numbers; it’s about the bigger picture and how these decisions affect real people and businesses.

How to Prepare for FOMC Meetings

Alright, so now that you know the what, why, and how of FOMC meetings, let’s talk about how to prepare for them. Whether you’re a trader, investor, or just someone keeping an eye on the economy, there are a few things you can do to get ready.

Here’s a quick checklist:

- Mark the Dates: Add the FOMC meeting dates to your calendar so you don’t miss any important announcements.

- Stay Informed: Follow economic news and keep an eye on key indicators like inflation, unemployment, and GDP growth.

- Adjust Your Strategy: If you’re a trader or investor, consider adjusting your portfolio in anticipation of potential market moves.

By staying proactive and informed, you can position yourself to make the most of the FOMC’s decisions. It’s like having a roadmap for navigating the financial markets, and the FOMC meetings are the key landmarks on that map.

Common Misconceptions About FOMC Meetings

Before we wrap up, let’s clear up a few common misconceptions about FOMC meetings:

- They’re Not Just for Traders: While traders and investors pay close attention to FOMC meetings, they affect everyone. Even if you’re not actively involved in the markets, these decisions can impact your everyday life.

- They’re Not Always Volatile: Not every FOMC meeting leads to massive market swings. Sometimes, the decisions are in line with expectations, and the market reacts calmly.

- They’re Not Perfect: The FOMC doesn’t always get it right. Economic conditions can change rapidly, and their decisions might not always have the desired effect.

Understanding these misconceptions can help you approach FOMC meetings with a more balanced perspective. It’s not all about dramatic market moves or perfect decision-making; it’s about navigating the economic landscape and making the best choices you can.

Conclusion: Why FOMC Meeting Time Matters

So, there you have it—your ultimate guide to understanding FOMC meeting time and why it matters. Whether you’re a seasoned trader or just someone trying to make sense of the economic world, these meetings are worth paying attention to. They shape monetary policy, influence interest rates, and can have a significant impact on the markets and the economy as a whole.

To recap:

- The FOMC meets eight times a year to discuss and decide on monetary policy.

- These meetings can affect everything from interest rates to stock prices.

MT St Mary's Basketball: Your Ultimate Guide To The Mountaineers

What Is WMBD? A Deep Dive Into World Migratory Bird Day

El Salvador National Football Team: The Heartbeat Of Central American Football

FOMC Meeting Schedule

FOMC Live Get the Latest Updates on Interest Rates

FOMC Live Get the Latest Updates on Interest Rates