Fed Rate: The Pulse Of The Global Economy And Why It Matters To You

Have you ever wondered why the stock market gets all jittery when people start talking about the Fed rate? Or why your mortgage payment might suddenly go up or down based on decisions made in some fancy boardroom in Washington, D.C.? The Fed rate—or Federal Funds Rate—is one of the most powerful tools in the financial world, and it affects everything from your wallet to global trade. But what exactly is this mysterious rate, and why should you care? Let’s dive into it.

Picture this: The Federal Reserve (also known as "the Fed") is like the captain of the economic ship. Their job is to steer the U.S. economy toward steady growth, low unemployment, and stable prices. One of their key tools for doing this is the Fed rate. Think of it as the gas pedal—or sometimes the brake—for the economy. When the Fed raises or lowers this rate, it sends ripples through the entire financial system, affecting everything from business loans to credit card interest rates.

But here’s the thing: understanding the Fed rate isn’t just for economists or Wall Street types. Whether you’re saving for a house, planning for retirement, or just trying to make ends meet, the Fed rate can impact your financial life in ways you might not even realize. So, buckle up because we’re about to break it down in a way that even your non-finance-savvy friend will get.

What Exactly Is the Fed Rate Anyway?

Alright, let’s start with the basics. The Fed rate is the interest rate that banks charge each other for overnight loans. Yep, you heard that right—banks borrow money from each other all the time, and the Fed sets the guidelines for how much interest they can charge. This rate is crucial because it influences other interest rates across the board, like those on mortgages, car loans, and even credit cards.

Here’s a fun fact: The Fed doesn’t directly control the Fed rate. Instead, they set a target range, and the actual rate fluctuates within that range based on supply and demand in the market. It’s kind of like a dance where the Fed leads, but the banks follow their own rhythm. And trust me, it’s a dance that everyone in the financial world is watching closely.

Why Does the Fed Rate Matter So Much?

The Fed rate is more than just a number—it’s a signal. When the Fed lowers the rate, it’s usually trying to stimulate the economy by making borrowing cheaper. This encourages businesses to invest and consumers to spend more. On the flip side, when the Fed raises the rate, it’s often trying to slow down inflation by making borrowing more expensive. It’s all about finding that sweet spot where the economy grows without overheating.

And here’s the kicker: the Fed rate doesn’t just affect the U.S. economy. Because the dollar is the world’s reserve currency, changes in the Fed rate can have ripple effects around the globe. For example, if the Fed raises rates, it can make the dollar stronger, which affects everything from import prices to foreign investments.

How Does the Fed Rate Impact Your Wallet?

So, how does this all play out in your everyday life? Well, let’s break it down. If you have a variable-rate mortgage, your monthly payments could go up if the Fed raises rates. If you’re carrying a balance on your credit card, you might see higher interest charges. On the flip side, if you’ve got savings in the bank, higher rates could mean better returns on your deposits.

But it’s not all about loans and savings. The Fed rate also affects job prospects, stock market performance, and even the cost of goods and services. In short, it’s a big deal for anyone who participates in the economy—and that’s pretty much everyone.

Real-Life Examples of Fed Rate Impact

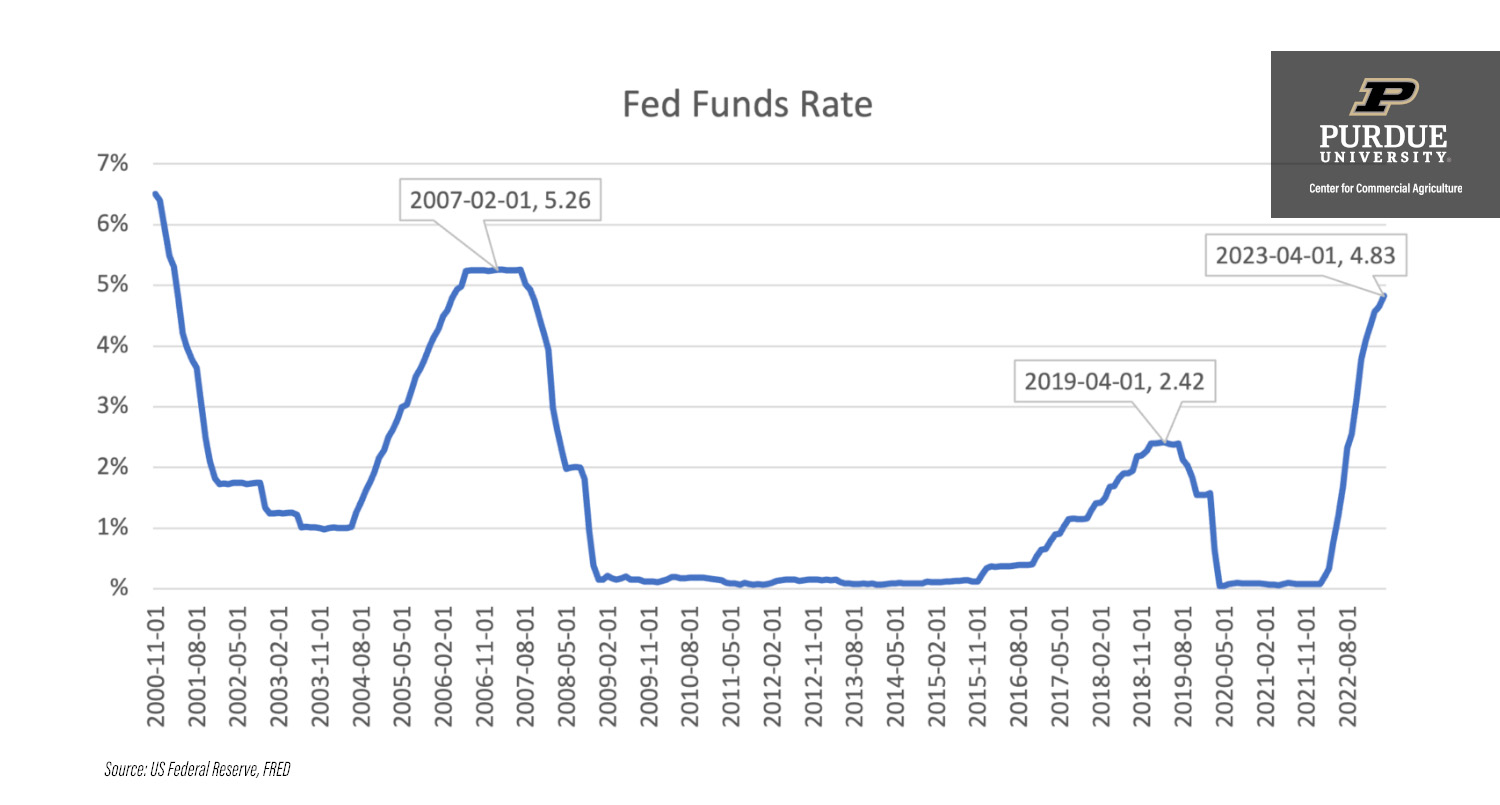

- 2008 Financial Crisis: During the Great Recession, the Fed slashed rates to near zero to stimulate lending and spending. This helped prevent a complete economic meltdown.

- 2022 Rate Hikes: In response to skyrocketing inflation, the Fed raised rates multiple times in 2022. This helped bring inflation under control but also led to higher borrowing costs for consumers and businesses.

The History of the Fed Rate

To truly understand the Fed rate, you need to know its history. The Federal Reserve was established in 1913, but it wasn’t until the 1980s that the Fed started using the Fed rate as a primary tool for managing the economy. Under the leadership of Chairman Paul Volcker, the Fed aggressively raised rates to combat runaway inflation, ushering in an era of more disciplined monetary policy.

Since then, the Fed has used the rate to navigate everything from economic booms to recessions. And while the tools and strategies have evolved, the goal has remained the same: to keep the economy on an even keel.

Key Moments in Fed Rate History

- 1980s: Volcker’s rate hikes brought inflation down but caused a recession.

- 2008: Rates were slashed to near zero during the financial crisis.

- 2020: Rates were cut to zero again during the pandemic to support the economy.

Who Sets the Fed Rate?

Now, here’s where things get interesting. The Fed rate isn’t set by just one person—it’s decided by the Federal Open Market Committee (FOMC), a group of Fed officials who meet several times a year to discuss monetary policy. These meetings are like the Super Bowl of finance, with analysts and investors hanging on every word.

At these meetings, the FOMC looks at a bunch of economic data—things like inflation rates, unemployment numbers, and GDP growth—to decide whether to raise, lower, or keep the Fed rate the same. It’s a complex process that involves a lot of debate and analysis, but the end result has a huge impact on the economy.

Who Are the Key Players?

The FOMC is made up of 12 members, including the Fed Chair and other regional Fed bank presidents. Each member brings their own perspective to the table, and their votes can sway the outcome of the decision. As of 2023, Jerome Powell serves as the Fed Chair, and his decisions have been closely watched by markets around the world.

How the Fed Rate Affects Global Markets

Let’s talk about the big picture. The Fed rate doesn’t just affect the U.S. economy—it has global implications. For example, when the Fed raises rates, it can make the dollar stronger, which can hurt U.S. exports but benefit foreign investors. Conversely, when the Fed lowers rates, it can weaken the dollar, making U.S. goods more competitive on the global stage.

And then there’s the stock market. Investors are always trying to predict what the Fed will do next, and even hints of a rate change can send markets into a frenzy. It’s a game of cat and mouse where everyone is trying to stay one step ahead.

Case Studies: Global Impact of Fed Rate Changes

- 2013 Taper Tantrum: When the Fed hinted at reducing its bond-buying program, global markets panicked, leading to volatility in emerging markets.

- 2015 Rate Hike: The Fed’s first rate hike since the Great Recession caused ripples in global currency markets.

Understanding the Fed Rate in Plain English

Let’s break it down in simpler terms. Imagine the economy is like a car, and the Fed rate is the gas pedal. When the economy is sluggish, the Fed presses the pedal by lowering rates to get things moving. When the economy is running too fast and inflation is rising, the Fed taps the brakes by raising rates to slow things down.

Of course, it’s not always that simple. There are lots of factors at play, and sometimes the Fed has to make tough decisions that aren’t popular. But the goal is always the same: to keep the economy healthy and stable.

Common Misconceptions About the Fed Rate

- Myth 1: The Fed controls all interest rates. Nope! The Fed rate is just one piece of the puzzle.

- Myth 2: Lower rates are always better. Not necessarily. Sometimes higher rates are needed to control inflation.

How to Prepare for Fed Rate Changes

So, what can you do to protect yourself from the ups and downs of the Fed rate? Here are a few tips:

- Refinance Debt: If rates are low, consider refinancing your mortgage or student loans to lock in a better rate.

- Review Investments: Make sure your portfolio is diversified to handle potential market volatility.

- Save Wisely: Look for savings accounts or CDs that offer higher interest rates when the Fed raises rates.

Conclusion: Why the Fed Rate Matters to You

In the end, the Fed rate is one of the most important factors affecting the global economy—and your personal finances. Whether you’re a homeowner, investor, or just someone trying to make ends meet, understanding how the Fed rate works can help you make smarter financial decisions.

So, the next time you hear chatter about the Fed rate, don’t tune it out. Pay attention because it could affect your wallet in ways you might not expect. And if you’ve learned something from this article, why not share it with a friend? Or leave a comment below and let us know what you think. After all, knowledge is power—and in this case, it’s financial power.

Table of Contents

- What Exactly Is the Fed Rate Anyway?

- Why Does the Fed Rate Matter So Much?

- How Does the Fed Rate Impact Your Wallet?

- The History of the Fed Rate

- Who Sets the Fed Rate?

- How the Fed Rate Affects Global Markets

- Understanding the Fed Rate in Plain English

- Common Misconceptions About the Fed Rate

- How to Prepare for Fed Rate Changes

- Conclusion: Why the Fed Rate Matters to You

Andrew And Tristan Tate: The Rise Of The Modern-Day Renaissance Men

Unlocking The Secrets Of WXYZ: Everything You Need To Know

Happy Nowruz: A Celebration Of Renewal, Harmony, And Cultural Richness

Fed interest rate SeetaDenholm

Fed Rate Increases 2025 Tiff Shandra

Fed Rate Predictions 2024 Lou Agnella