Fed News: The Latest Buzz Straight From The Central Banking Hive

Hey there, finance enthusiasts! Let's dive right into the world of Fed news, where numbers meet policy, and decisions ripple through the global economy like a stone dropped in a pond. If you've ever wondered what all the fuss is about when people talk about the Federal Reserve, you're in the right place. This isn't just about interest rates or economic jargon; it's about understanding the heartbeat of the financial world. So, buckle up because we’re about to break it down for you in a way that’s as easy as pie—and maybe just as sweet.

Now, let’s set the stage. The Federal Reserve, often referred to as "the Fed," is no ordinary institution. It's the central banking system of the United States, and its every move can make or break markets. Whether it's adjusting interest rates, dealing with inflation, or managing monetary policy, the Fed is always in the spotlight. And guess what? You don’t have to be an economist to care. The decisions made by the Fed affect everything from your mortgage rate to the price of that avocado toast you love so much.

So, why are we so obsessed with Fed news? Well, because it’s the pulse of the economy. It’s like being privy to the backstage of a massive financial performance. Every statement, every meeting, and every decision is a chapter in the ever-evolving story of the global economy. Stick around, and we’ll decode the Fed's actions, their implications, and why they matter to you—yes, even you who don’t trade stocks or manage a hedge fund.

What Exactly is Fed News?

Fed news refers to any updates, announcements, or developments related to the Federal Reserve. Think of it as the latest gossip from the central banking world, except this gossip has the power to shake markets and influence economies. These updates can come in various forms, from press releases and official statements to speeches by Fed officials and economic projections. And trust me, the financial world listens closely whenever the Fed has something to say.

One of the most anticipated events in the Fed news calendar is the Federal Open Market Committee (FOMC) meetings. These meetings happen eight times a year, and they’re where key decisions about monetary policy are made. From setting benchmark interest rates to discussing the state of the economy, the FOMC meetings are like the Super Bowl of central banking. Every word uttered during these meetings is scrutinized, dissected, and analyzed by economists, traders, and investors worldwide.

But Fed news isn’t just about the big meetings. Sometimes, it’s the little things that make the biggest waves. A casual comment from a Fed official, a subtle change in language in a press release, or even a tweet (yes, tweets!) can send shockwaves through the markets. That’s why staying updated on Fed news is crucial for anyone who wants to navigate the financial landscape with confidence.

Why Should You Care About Fed News?

Here’s the deal: whether you’re a seasoned investor or someone just trying to make ends meet, Fed news impacts your life. When the Fed adjusts interest rates, it doesn’t just affect the stock market; it affects your wallet too. Lower interest rates can make borrowing cheaper, which is great if you’re thinking about buying a house or starting a business. On the flip side, higher interest rates can mean more expensive loans, but they can also lead to better savings rates for those with money in the bank.

But it’s not just about interest rates. The Fed’s decisions on monetary policy can influence inflation, employment rates, and even the value of the dollar. For instance, if the Fed raises interest rates to combat inflation, it can lead to slower economic growth, which might mean fewer job opportunities. Conversely, if the Fed lowers rates to stimulate the economy, it could lead to more job creation but at the risk of higher inflation.

And let’s not forget the global impact. The Fed’s actions don’t just affect the U.S. economy; they have ripple effects around the world. When the Fed changes its monetary policy, it can influence currency exchange rates, trade balances, and even the stability of other countries’ economies. So, whether you’re a global citizen or just someone interested in the bigger picture, Fed news is worth paying attention to.

Breaking Down the Fed’s Role

To truly understand Fed news, you need to know what the Fed does. At its core, the Federal Reserve is tasked with maintaining the stability of the U.S. financial system. It does this by setting monetary policy, regulating banks, and providing financial services to the government. But its most visible role is in managing the economy through interest rates and other tools.

- Monetary Policy: The Fed uses monetary policy to influence the economy. This includes setting interest rates, controlling the money supply, and managing inflation.

- Bank Regulation: The Fed also plays a crucial role in regulating banks to ensure they’re safe and sound. This helps protect consumers and maintain public confidence in the financial system.

- Financial Services: The Fed provides various financial services to the U.S. government, including managing the country’s cash and securities.

These roles might sound technical, but they have real-world implications. For example, when the Fed regulates banks, it ensures they’re not taking excessive risks that could lead to another financial crisis. And when it manages monetary policy, it’s trying to strike a balance between economic growth, inflation, and employment.

Key Players in the Fed News Arena

While the Fed is an institution, it’s made up of people. And these people are the ones making the decisions that shape Fed news. At the helm is the Federal Reserve Board of Governors, a group of seven individuals appointed by the President and confirmed by the Senate. Among them, the Chair of the Federal Reserve is perhaps the most visible and influential figure. Think of them as the captain of the ship, guiding the Fed through turbulent waters.

Then there’s the Federal Open Market Committee (FOMC), a group of 12 members responsible for setting monetary policy. This committee includes the seven members of the Board of Governors, the President of the Federal Reserve Bank of New York, and four other Reserve Bank presidents who rotate in and out of voting positions. Together, they decide on interest rates and other key policies that influence the economy.

But it’s not just the top brass who matter. Every regional Federal Reserve Bank has its own president, and their voices can carry weight in shaping Fed news. Sometimes, a speech by a regional Fed president can provide insight into the thinking of the broader institution, giving markets a glimpse into what might be coming down the pipeline.

Understanding the Fed’s Tools

Alright, let’s get into the nitty-gritty of how the Fed actually does its job. The Fed has a toolbox full of instruments it uses to influence the economy, and understanding these tools can help you make sense of Fed news. Here are some of the key tools:

- Interest Rates: The Fed sets the federal funds rate, which is the interest rate banks charge each other for overnight loans. This rate influences everything from mortgage rates to credit card interest rates.

- Open Market Operations: The Fed buys and sells government securities to influence the money supply. When it buys securities, it injects money into the economy; when it sells them, it takes money out.

- Reserve Requirements: The Fed sets the amount of money banks are required to keep on hand. Lowering reserve requirements can encourage lending, while raising them can slow it down.

- Forward Guidance: Sometimes, the Fed uses words as a tool. By signaling its future intentions through statements or speeches, it can influence market expectations and behavior.

Each of these tools plays a role in the Fed’s mission to maintain economic stability. And when you see Fed news about interest rate hikes, bond purchases, or changes in reserve requirements, you’re seeing the Fed in action, using its tools to steer the economy in the right direction.

The Impact of Fed News on Markets

Now, let’s talk about how Fed news affects the markets. When the Fed makes a decision, it’s like dropping a pebble in a pond. The ripples spread far and wide, influencing everything from stock prices to bond yields. For instance, if the Fed raises interest rates, it can lead to lower stock prices as borrowing becomes more expensive. But it can also lead to higher bond yields, making fixed-income investments more attractive.

And it’s not just the big players who feel the impact. Individual investors, business owners, and even consumers are affected by Fed news. If you’re saving for retirement, planning to buy a house, or just trying to manage your day-to-day finances, the Fed’s decisions can have a direct impact on your financial well-being.

But here’s the thing: the markets don’t always react the way you’d expect. Sometimes, a rate hike can send stocks soaring if it’s seen as a sign of a strong economy. Other times, a dovish statement from the Fed can lead to market volatility if investors fear the economy is weakening. That’s why understanding the context of Fed news is so important.

The History of the Federal Reserve

Before we dive deeper into Fed news, let’s take a quick trip back in time to understand how the Federal Reserve came to be. Established in 1913 by the Federal Reserve Act, the Fed was created in response to a series of financial panics that had rocked the U.S. economy. At the time, the country lacked a central authority to manage the financial system, leading to instability and frequent crises.

The Fed’s original mission was to provide the nation with a safer, more flexible, and more stable monetary and financial system. Over the years, its role has evolved, but its core mission remains the same. Today, the Fed is one of the most powerful institutions in the world, with a mandate to promote maximum employment, stable prices, and moderate long-term interest rates.

Throughout its history, the Fed has faced its share of challenges. From the Great Depression to the 2008 financial crisis, the Fed has had to navigate some of the toughest economic storms. And each time, it’s learned and adapted, refining its tools and strategies to better serve the economy.

Key Moments in Fed History

Let’s highlight a few key moments in the Fed’s history that have shaped its role and influence:

- The Great Depression: In the 1930s, the Fed faced criticism for not doing enough to prevent the economic collapse. This led to significant reforms and a greater focus on monetary policy.

- The Volcker Era: In the late 1970s and early 1980s, under Chairman Paul Volcker, the Fed took aggressive action to combat inflation, even at the cost of causing a recession.

- The 2008 Financial Crisis: During the crisis, the Fed implemented unprecedented measures, including quantitative easing, to stabilize the financial system and stimulate the economy.

These moments illustrate the Fed’s evolving role in managing the economy and its willingness to take bold action when necessary. And they provide valuable context for understanding today’s Fed news.

The Future of the Federal Reserve

As we look to the future, the Fed faces new challenges and opportunities. The rise of digital currencies, the impact of climate change on the economy, and the increasing interconnectedness of global markets are just a few of the issues the Fed must navigate. And as technology continues to transform the financial landscape, the Fed will need to adapt its tools and strategies to remain effective.

One area of focus is the development of a Central Bank Digital Currency (CBDC). As more countries explore the possibility of digital currencies, the Fed is considering whether to create its own. A CBDC could revolutionize the way money is used and managed, but it also raises questions about privacy, security, and financial inclusion.

Another challenge is addressing economic inequality. While the Fed’s traditional tools are designed to manage the overall economy, there’s growing recognition that they can also play a role in promoting more equitable outcomes. This could involve rethinking how monetary policy is implemented and ensuring that its benefits are felt by all segments of society.

Challenges Ahead

Of course, the Fed’s future isn’t without its challenges. Political pressures, global uncertainties, and the ever-changing nature of the economy will continue to test the institution’s ability to adapt and innovate. But one thing is certain: the Fed will remain a key player in shaping the financial landscape, and Fed news will continue to be a critical source of information for anyone interested in the economy.

How to Stay Updated on Fed News

So, how do you stay on top of Fed news? In today’s digital age, there are plenty of ways to keep yourself informed. Start by following reputable financial news outlets like Bloomberg, Reuters, and CNBC. These sources provide real-time updates on Fed news and analysis from experts in the field.

But don’t stop there. The Fed itself is a great resource. Its website offers a wealth of information, including press releases, economic data, and transcripts of FOMC meetings. And if you want to hear directly from the Fed’s leaders, you can watch their speeches and interviews, which are often available online.

Social media can also be a valuable tool for staying updated. Follow Fed officials and

Bam Adebayo: The Rising Star Who’s Dominating The NBA Scene

Aubrey Plaza Husband: The Inside Scoop On Her Love Life And Family

Loretta Lynn: The Queen Of Country Music Who Touched Our Hearts

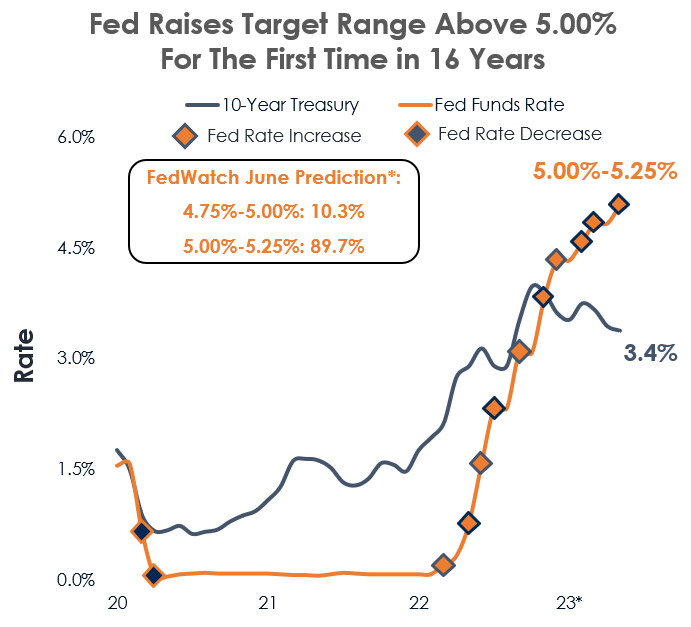

Fed raises rates by 25 basis points, expects 'ongoing' increases

Breaking FED News The Biggest Market Moves You NEED to Know

FED Meeting & Banking News CRE Implications Limon Net Lease Group