Interest Rates: The Key To Unlocking Your Financial Potential

Interest rates might sound boring, but trust me, they're a big deal. Whether you're saving for your dream home or trying to pay off that pesky credit card debt, interest rates play a huge role in shaping your financial future. Think of them as the silent puppet master pulling the strings behind the scenes. They affect everything from how much you earn on your savings to how much you pay for that new car loan.

Now, I know what you're thinking. "Why should I care about interest rates?" Well, my friend, if you want to make smart financial decisions, you need to understand how these little numbers can have a massive impact on your wallet. It's like knowing the secret code to unlock hidden treasures in the world of finance.

So, let's dive into the world of interest rates, where we'll break down what they are, how they work, and why you should care. By the end of this article, you'll be armed with knowledge that can help you save money, make smarter investment choices, and even negotiate better deals. Sound good? Let's get started!

Table of Contents

- What Are Interest Rates?

- How Interest Rates Impact You

- Biography of Interest Rates

- Types of Interest Rates

- Factors Affecting Interest Rates

- Global Perspective on Interest Rates

- Strategies to Tackle Interest Rates

- Future of Interest Rates

- Common Misconceptions About Interest Rates

- Conclusion and Next Steps

What Are Interest Rates?

Interest rates are basically the cost of borrowing money or the reward for lending it. Think of it like a rental fee for using someone else's cash. When you take out a loan, the lender charges you interest as a way to make a profit. On the flip side, when you deposit money into a savings account, the bank pays you interest as a thank-you for letting them use your cash.

Interest rates are expressed as a percentage of the principal amount, and they can vary depending on a bunch of factors. For example, if you're borrowing money to buy a house, the interest rate on your mortgage might be different from the rate on your credit card. It's all about risk and reward, baby.

How Do Interest Rates Work?

Interest rates work by calculating the cost of borrowing over a specific period of time. For instance, if you borrow $1,000 at an interest rate of 5%, you'll end up paying back $1,050. Simple, right? But here's the kicker—interest rates can be fixed or variable. Fixed rates stay the same throughout the life of the loan, while variable rates can fluctuate based on market conditions.

So, why do interest rates change? Well, it's all about supply and demand. When the economy is booming, interest rates tend to rise because lenders want to cash in on the good times. But when things slow down, interest rates might drop to encourage borrowing and stimulate growth.

How Interest Rates Impact You

Interest rates have a direct impact on your daily life, whether you realize it or not. They affect everything from your monthly mortgage payment to the cost of financing that new car. If interest rates are high, borrowing money becomes more expensive, which can put a damper on your spending plans. But if rates are low, it's a great time to take out a loan or refinance existing debt.

Saving vs. Borrowing

When interest rates are low, it's a great time to borrow money because the cost of financing is cheaper. But if you're a saver, low interest rates can be a bit of a bummer because your savings won't grow as quickly. On the flip side, when interest rates are high, savers rejoice because their money earns more interest, but borrowers might feel the pinch of higher payments.

It's all about balancing the scales and figuring out what works best for your financial situation. Do you want to take advantage of low rates to buy a house, or are you focused on growing your savings for retirement? The choice is yours, but interest rates will definitely play a role in your decision-making process.

Biography of Interest Rates

Interest rates have been around for centuries, dating back to ancient civilizations like the Sumerians and Babylonians. Back in the day, lending money was a risky business, so lenders charged high interest rates to protect themselves from potential losses. Over time, interest rates evolved to become the sophisticated financial tool we know today.

Here's a quick rundown of some key moments in the history of interest rates:

- Ancient Times: Interest rates were often tied to religious and moral beliefs, with some cultures viewing usury (charging excessive interest) as a sin.

- Medieval Period: The Catholic Church banned usury, but lenders found creative ways to charge interest without breaking the rules.

- Modern Era: Central banks emerged as the gatekeepers of interest rates, using them to control inflation and stabilize economies.

Data and Facts About Interest Rates

| Year | Highest Rate | Lowest Rate | Average Rate |

|---|---|---|---|

| 1980 | 20% | 10% | 15% |

| 2000 | 10% | 4% | 7% |

| 2020 | 3% | 0.25% | 1.5% |

Types of Interest Rates

Not all interest rates are created equal. There are several types of interest rates, each serving a different purpose in the financial world. Let's break them down:

Prime Rate

The prime rate is the interest rate that banks charge their most creditworthy customers. It's like the VIP pass of interest rates, reserved for those with stellar credit scores. The prime rate serves as a benchmark for other interest rates, such as mortgage rates and credit card rates.

Federal Funds Rate

The federal funds rate is the interest rate at which banks lend money to each other overnight. It's controlled by the Federal Reserve and is a key tool for managing the economy. When the Fed raises or lowers the federal funds rate, it sends ripples through the entire financial system.

Factors Affecting Interest Rates

Interest rates don't just pop up out of nowhere. They're influenced by a variety of factors, both domestic and global. Here are some of the big players:

- Inflation: When prices go up, interest rates often follow suit to keep the economy in check.

- Economic Growth: Strong economic growth can lead to higher interest rates as demand for borrowing increases.

- Central Bank Policies: Central banks like the Federal Reserve have the power to adjust interest rates to achieve their economic goals.

Global Perspective on Interest Rates

Interest rates aren't just a local issue—they're a global phenomenon. What happens in one country can have a ripple effect on interest rates around the world. For example, if the U.S. raises interest rates, it can attract foreign investors looking for higher returns, which can impact currency exchange rates and global trade.

Comparing Interest Rates Across Countries

Some countries have negative interest rates, which might sound crazy, but it's a strategy used to encourage borrowing and spending. Meanwhile, other countries might have sky-high interest rates to combat inflation or stabilize their economies. It's a wild ride, and interest rates are at the center of it all.

Strategies to Tackle Interest Rates

So, how can you navigate the world of interest rates and make them work for you? Here are a few strategies:

- Lock in Low Rates: If interest rates are low, consider refinancing your mortgage or consolidating your debt to take advantage of cheaper borrowing costs.

- Shop Around: Don't settle for the first interest rate you see. Do your research and compare offers from different lenders to find the best deal.

- Build Your Credit Score: A higher credit score can get you better interest rates, so it pays to keep your financial house in order.

Future of Interest Rates

The future of interest rates is anyone's guess, but one thing is for sure—they'll continue to play a crucial role in the global economy. With advancements in technology and changes in consumer behavior, interest rates might evolve in ways we can't even imagine yet. But one thing remains constant—the importance of understanding how they affect your financial well-being.

Common Misconceptions About Interest Rates

There are plenty of myths and misconceptions floating around about interest rates. Here are a few of the big ones:

- Lower Rates Always Mean Cheaper Loans: Not necessarily. Hidden fees and other charges can add up, so it's important to read the fine print.

- Interest Rates Only Affect Borrowers: Nope! Savers also need to pay attention to interest rates, especially if they're relying on interest income for retirement.

Conclusion and Next Steps

Interest rates might not be the sexiest topic in the world, but they're definitely one of the most important when it comes to your financial health. By understanding how they work and how they impact your life, you can make smarter decisions that can save you money and help you achieve your financial goals.

So, what's next? Take a look at your current loans and savings accounts. Are you getting the best interest rates possible? If not, it might be time to shop around and find a better deal. And don't forget to keep an eye on global economic trends, as they can give you a heads-up on where interest rates might be headed next.

Got any questions or thoughts? Drop a comment below and let's chat. And if you found this article helpful, don't forget to share it with your friends and family. Knowledge is power, and when it comes to interest rates, a little knowledge can go a long way!

Bachelorette Katie Thurston Opens Up About Breast Cancer Battle

Texas Likely To Fire Rodney Terry After First Four Loss To Xavier

Exclusive: Wade To Leave McNeese For NC State Job

![Buying a Home? Mortgage Rate Guide for Singapore [2023]](https://blog.roshi.sg/wp-content/uploads/2022/08/Singapore-Home-Loan-Rates-2022.jpeg)

Buying a Home? Mortgage Rate Guide for Singapore [2023]

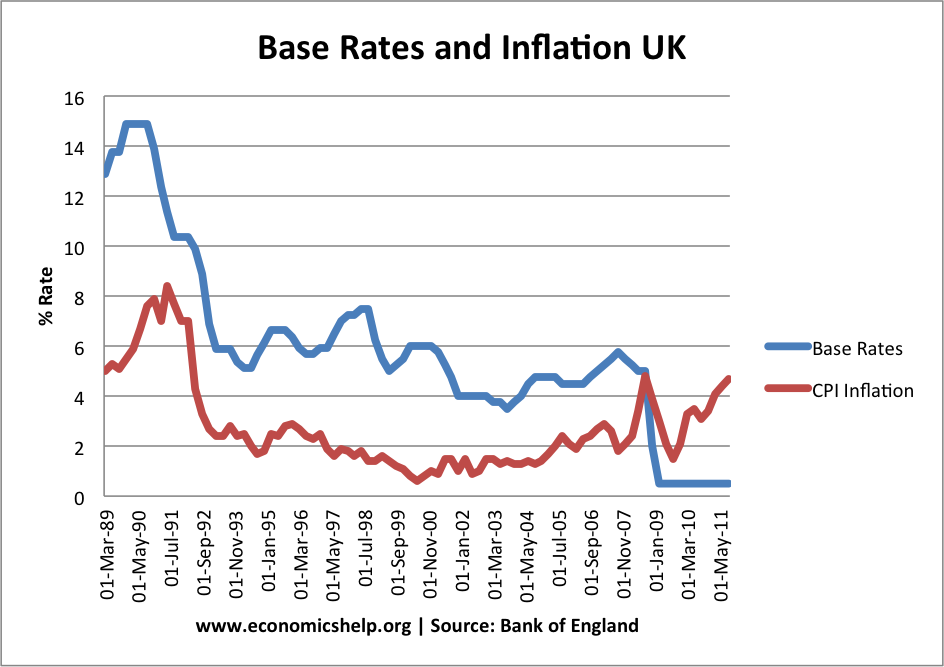

Interest Rates and the Economy Economics Help

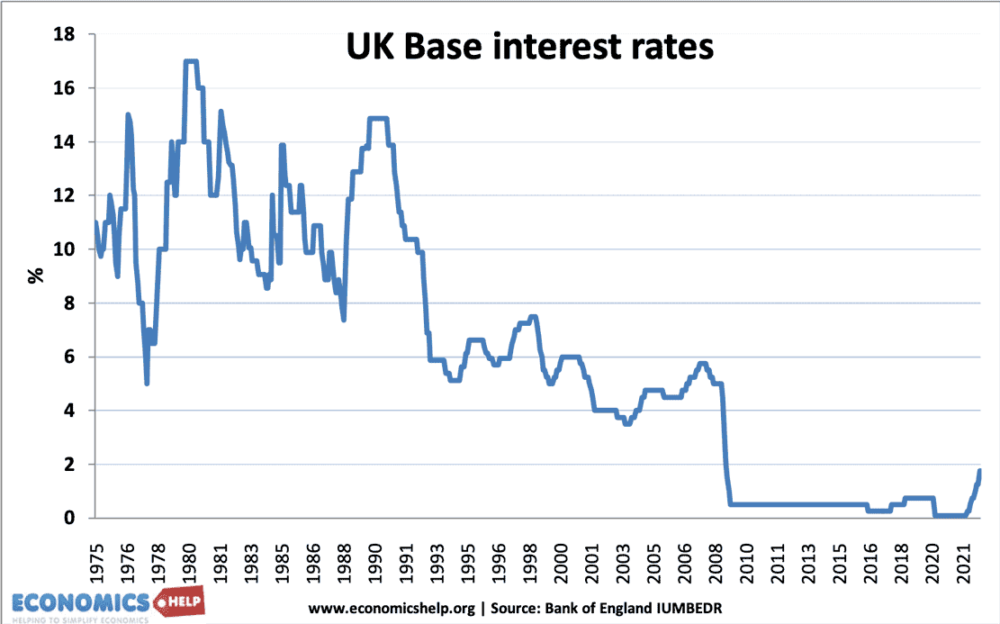

Historical Interest Rates UK Economics Help