FOMC: The Powerhouse Driving Global Economic Decisions

Alright folks, let’s dive straight into the heart of the matter. The Federal Open Market Committee, or FOMC for short, is a big deal in the world of finance. It’s like the secret society that shapes the economic destiny of the United States and, by extension, the entire globe. The FOMC is where decisions are made that affect interest rates, monetary policy, and ultimately your wallet. So, if you’re wondering why the stock market goes up or down, or why your mortgage rate might suddenly change, the FOMC has a lot to do with it.

This ain’t just a bunch of economists sitting around a table debating theory. No, this is real-world stuff that impacts everyone. Whether you’re a Wall Street trader, a small business owner, or just someone trying to save for a rainy day, the FOMC’s decisions can make or break your financial plans. That’s why understanding what they do and how they operate is so crucial.

Now, before we dive deeper into the nitty-gritty, let me set the stage. The FOMC doesn’t operate in a vacuum. It’s part of the Federal Reserve System, the central bank of the U.S., and its job is to steer the economy in the right direction. But how do they do it? What tools do they use? And why should you care? Let’s explore these questions and more in the sections ahead.

What Exactly is the FOMC?

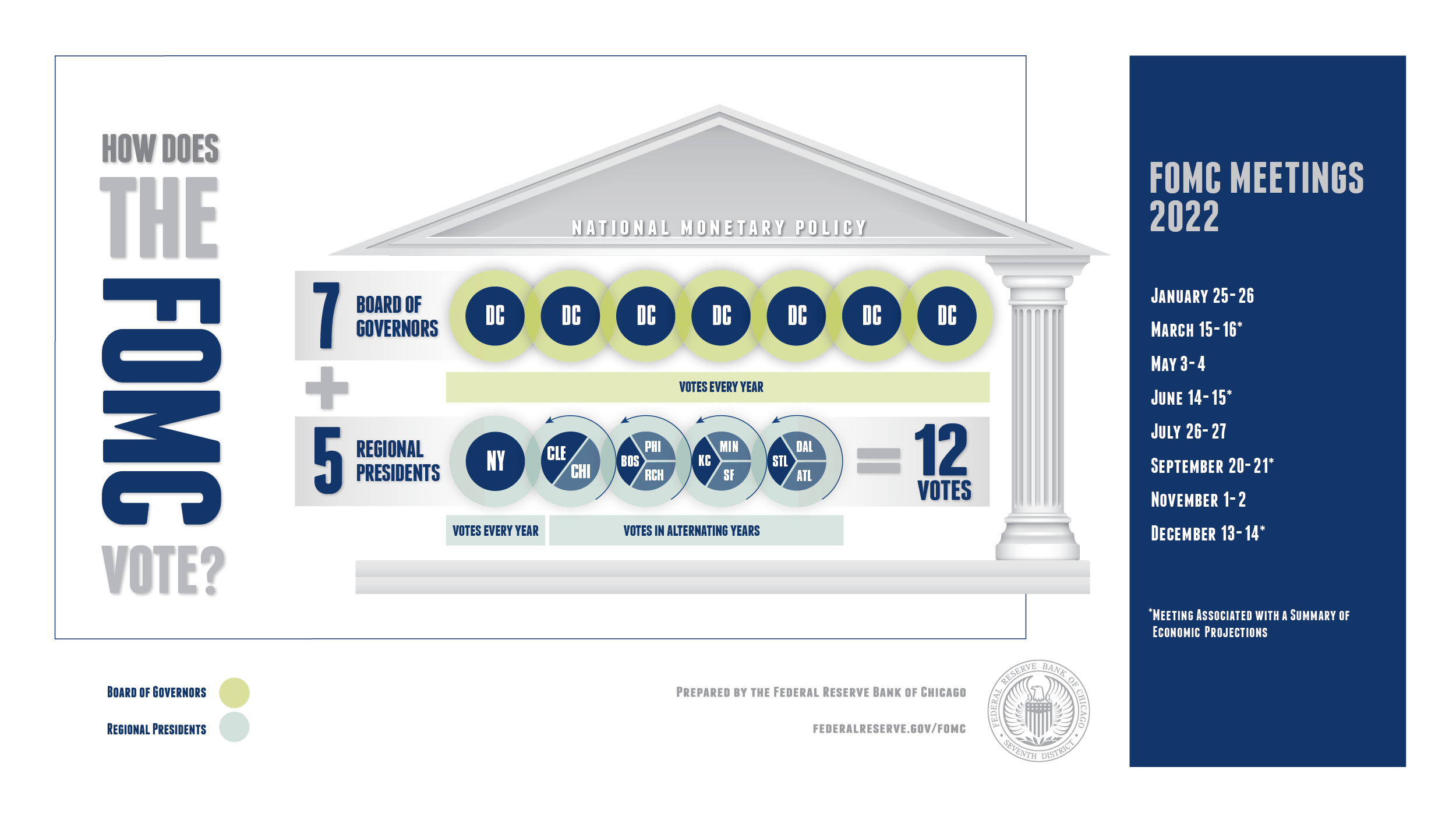

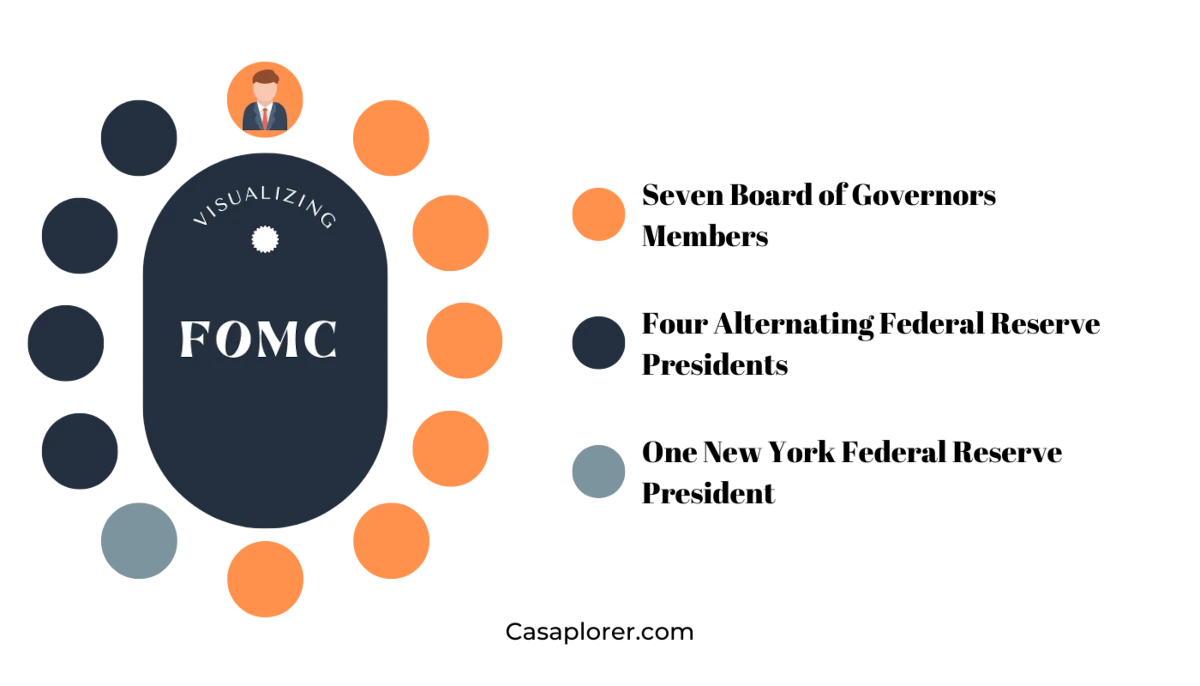

Let’s break it down. The FOMC is essentially the decision-making body within the Federal Reserve System. It’s made up of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents. This group meets eight times a year to discuss and decide on monetary policy actions. They’re the ones who pull the levers that affect interest rates and the supply of money in the economy.

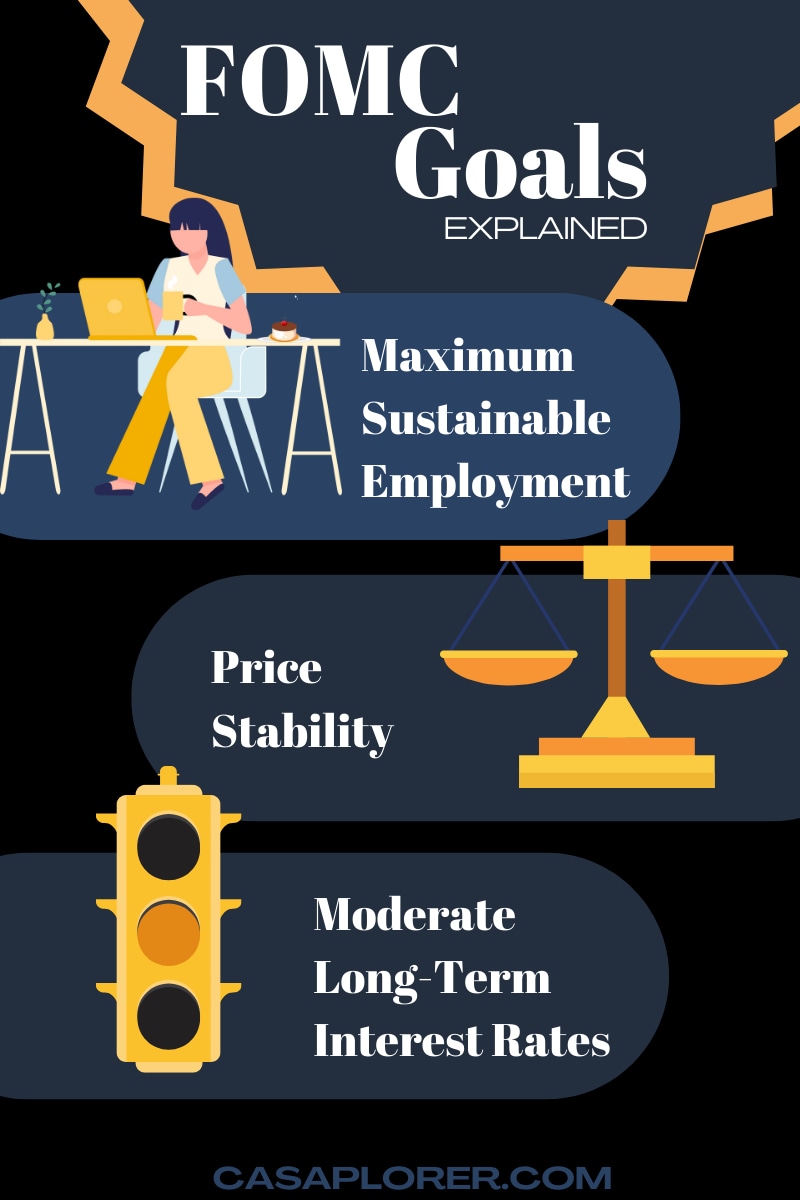

The FOMC’s primary goal is to promote maximum employment and stable prices. These might sound like simple objectives, but they’re incredibly complex to achieve. For instance, if unemployment is too high, the FOMC might lower interest rates to encourage borrowing and spending. On the flip side, if inflation is spiraling out of control, they might raise rates to cool things down. It’s a delicate balancing act that requires a lot of data analysis and foresight.

Who’s Who in the FOMC?

Ever wondered who these people are? Well, the FOMC is made up of some of the brightest minds in economics. The chair of the Federal Reserve, currently Jerome Powell, leads the committee. Alongside him are the other members of the Board of Governors, who are appointed by the President and confirmed by the Senate. The Federal Reserve Bank presidents, on the other hand, are selected by their respective banks’ boards of directors.

Each member brings a unique perspective to the table. Some might have a strong background in academia, while others might have spent years in the private sector. This diversity of experience helps the committee make well-rounded decisions that consider various angles of the economy.

How Does the FOMC Impact You?

Here’s the kicker: the FOMC’s decisions have a direct impact on your daily life. If you’ve ever taken out a loan, bought a house, or invested in the stock market, the FOMC’s actions have played a role. When they lower interest rates, borrowing becomes cheaper, which can stimulate economic growth. Conversely, when they raise rates, it can slow down spending and reduce inflation.

Let’s say you’re thinking about buying a car. If the FOMC decides to lower interest rates, you might get a better deal on your auto loan. On the flip side, if they raise rates, that shiny new car might start looking a lot more expensive. The same goes for mortgages, credit cards, and even savings accounts. The FOMC’s decisions ripple through the entire financial system.

The Tools in the FOMC’s Arsenal

So, how exactly does the FOMC wield its power? They have a few key tools at their disposal. The most well-known is setting the federal funds rate, which is the interest rate banks charge each other for overnight loans. By adjusting this rate, the FOMC can influence everything from consumer loans to business investments.

Another tool is open market operations, where the FOMC buys or sells government securities to control the money supply. If they want to inject more money into the economy, they buy securities. If they want to reduce the money supply, they sell them. It’s like turning a dial that controls the flow of cash.

Understanding the FOMC Meeting Process

The FOMC doesn’t just make decisions on a whim. They follow a structured process that involves a lot of data analysis and discussion. Each meeting typically lasts for two days, and during that time, members review economic reports, listen to presentations, and engage in deep discussions. It’s not just about numbers; it’s about understanding the broader economic landscape.

After the meeting, the FOMC releases a statement that outlines their decisions and provides insights into their reasoning. This statement is closely watched by economists, investors, and the media because it can signal future policy moves. For instance, if the statement hints at a potential rate hike, the stock market might react accordingly.

Key Players in the Meeting

While all members contribute to the discussions, some voices carry more weight than others. The chair of the Federal Reserve often sets the tone for the meeting and influences the direction of the discussions. Other influential members might include those with extensive experience in banking or those who represent regions heavily impacted by economic changes.

It’s also worth noting that the FOMC’s decisions are not always unanimous. Members might have differing opinions on the best course of action, and these differences can sometimes lead to heated debates. But at the end of the day, they aim to reach a consensus that serves the best interests of the economy.

Recent FOMC Decisions and Their Impact

Let’s take a look at some recent FOMC decisions and how they’ve affected the economy. In 2022, the FOMC embarked on a series of rate hikes to combat rising inflation. This move was met with mixed reactions. On one hand, it helped bring inflation under control. On the other hand, it increased the cost of borrowing, which put a strain on consumers and businesses alike.

Another notable decision was the emergency rate cut in response to the COVID-19 pandemic. In early 2020, the FOMC slashed rates to near zero to provide economic support during the crisis. This move helped stabilize financial markets and provided much-needed relief to businesses and individuals facing economic uncertainty.

Lessons Learned from Past Decisions

Every decision made by the FOMC comes with lessons. The rate hikes in the 1980s, for example, were crucial in taming hyperinflation but also led to a recession. These experiences shape the committee’s approach to future decisions, ensuring they learn from past mistakes and adapt to new challenges.

It’s also important to recognize that the FOMC operates in an ever-changing environment. What worked in the past might not work today, and the committee must constantly evolve its strategies to keep up with the times.

The Role of Data in FOMC Decisions

Data is the lifeblood of the FOMC. Without accurate and timely information, they wouldn’t be able to make informed decisions. They rely on a wide range of economic indicators, such as employment numbers, inflation rates, and GDP growth, to gauge the health of the economy.

One of the most important data points is the unemployment rate. If it’s too high, the FOMC might implement policies to stimulate job creation. Similarly, if inflation is rising too fast, they might take action to slow it down. It’s all about using data to guide policy decisions that promote economic stability.

Challenges in Data Interpretation

Interpreting economic data isn’t always straightforward. There can be lag times between when data is collected and when it’s analyzed, which can lead to delays in decision-making. Additionally, unexpected events, such as natural disasters or global pandemics, can throw a wrench into the best-laid plans.

Despite these challenges, the FOMC continues to refine its data analysis methods, incorporating new technologies and techniques to improve accuracy and timeliness. This commitment to staying ahead of the curve ensures they can respond quickly to any economic shifts.

Global Implications of FOMC Decisions

The FOMC’s influence extends far beyond U.S. borders. Because the U.S. dollar is the world’s reserve currency, any changes in monetary policy can have significant global ramifications. For instance, when the FOMC raises interest rates, it can lead to capital outflows from emerging markets as investors seek higher returns in the U.S. This can destabilize economies that rely heavily on foreign investment.

Conversely, when the FOMC lowers rates, it can lead to a flood of capital into emerging markets, boosting their economies. However, this influx can also lead to inflationary pressures if not managed properly. It’s a delicate dance that requires coordination with other central banks around the world.

Collaboration with Other Central Banks

The FOMC often works closely with other central banks to ensure global economic stability. During times of crisis, they might coordinate actions to provide liquidity and support to financial markets. This collaboration helps prevent systemic risks and ensures that no single country bears the brunt of economic turmoil.

It’s a testament to the interconnectedness of the global economy that the FOMC’s decisions can have such far-reaching effects. By working together with other central banks, they can address challenges more effectively and promote a more stable global financial system.

Looking Ahead: The Future of the FOMC

As we look to the future, the FOMC faces new challenges and opportunities. The rise of digital currencies, the impact of climate change on the economy, and the ongoing shift towards a more service-oriented economy are just a few of the factors they must consider. These changes require the FOMC to adapt its policies and approaches to ensure they remain effective in a rapidly evolving world.

One promising development is the increasing use of technology in economic analysis. Advanced data analytics and machine learning algorithms can help the FOMC make more accurate predictions and better-informed decisions. However, these tools must be used responsibly to avoid unintended consequences.

Final Thoughts and Call to Action

There you have it, folks. The FOMC is a powerful force in the world of finance, and understanding its role is crucial for anyone interested in the economy. Whether you’re a seasoned investor or just someone trying to make sense of the financial news, knowing how the FOMC operates can give you valuable insights into the direction of the economy.

So, what’s next? If you found this article helpful, I encourage you to share it with others. Knowledge is power, and the more people understand the FOMC, the better equipped we all are to navigate the complexities of the modern economy. And if you have any questions or comments, feel free to leave them below. Let’s keep the conversation going!

Table of Contents

- What Exactly is the FOMC?

- Who’s Who in the FOMC?

- How Does the FOMC Impact You?

- The Tools in the FOMC’s Arsenal

- Understanding the FOMC Meeting Process

- Recent FOMC Decisions and Their Impact

- The Role of Data in FOMC Decisions

- Global Implications of FOMC Decisions

- Looking Ahead: The Future of the FOMC

- Final Thoughts and Call to Action

Carrie Underwood's Tribute To Randy Travis Moves Grand Ole Opry Audience To Tears

Cruz Azul Vs Leon Amistoso: The Ultimate Clash You Don’t Want To Miss

What Does The Department Of Education Do? A Comprehensive Guide To Understanding Its Role And Impact

FOMC BejaySamael

FOMC Meetings 2022 and 2023

FOMC Meetings 2022 and 2023