Fed Rate: The Pulse Of Global Economy And Your Wallet

Ever wondered why the stock market goes crazy every time the Federal Reserve makes a move? The answer lies in the Fed rate. This seemingly simple number has the power to influence everything from your mortgage payments to the value of your retirement fund. But what exactly is the Fed rate, and why should you care? Let me break it down for you like we're having a chat over coffee.

Imagine the Fed rate as the heartbeat of the global economy. When it ticks up or down, ripples spread across financial markets, affecting businesses, investors, and yes, even your pocketbook. It's not just some abstract concept for economists to debate—it's a real factor that impacts your everyday life. So, let's dive in and explore why this matters to you and how it works.

In this article, we’ll unpack the Fed rate, its influence on the economy, and how it affects you personally. Whether you're a savvy investor or someone just trying to make sense of their monthly bills, understanding the Fed rate can give you a clearer picture of where the economy is heading. Stick around; it’s gonna be an eye-opener.

Table of Contents

- What is Fed Rate?

- A Brief History of the Fed Rate

- How the Fed Rate Works

- Effects on the Economy

- Controlling Inflation with Fed Rate

- Impact on Personal Finance

- Factors Affecting Fed Rate Decisions

- Global Implications of Fed Rate Changes

- Future Trends in Fed Rate Policy

- Conclusion: Why You Should Care About the Fed Rate

What is Fed Rate?

Alright, let’s start with the basics. The Fed rate—or federal funds rate—is the interest rate at which banks lend money to each other overnight. Yep, banks borrow from one another too, and the Fed sets the benchmark for how much they charge. This rate acts as a kind of anchor for all other interest rates in the economy.

Think of it like this: if the Fed rate goes up, borrowing costs for businesses and consumers increase. If it goes down, borrowing becomes cheaper. It’s a tool the Federal Reserve uses to manage economic growth, employment, and inflation. Simple, right? Well, not exactly. But don’t worry, we’ll get into the nitty-gritty later.

A Brief History of the Fed Rate

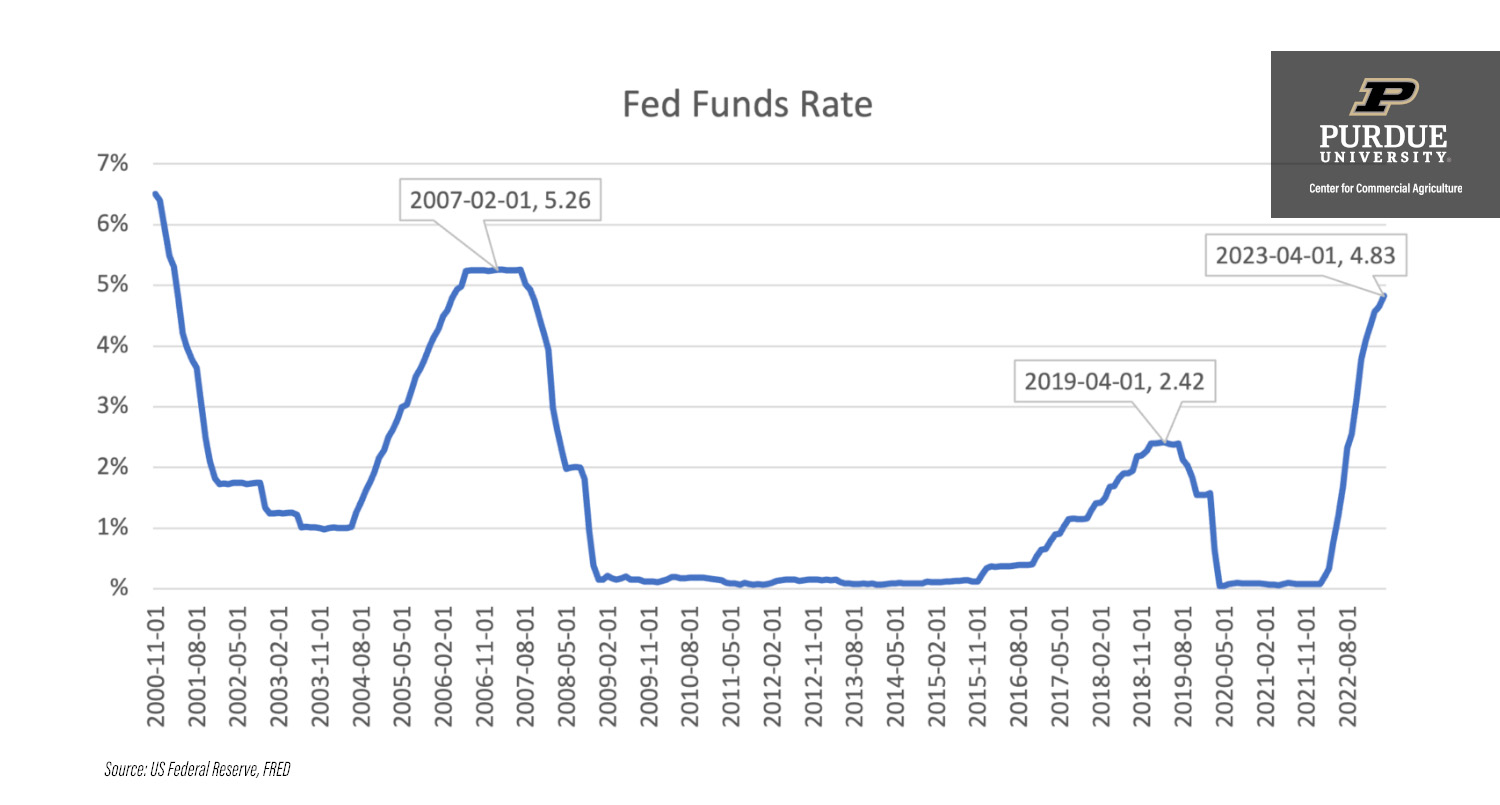

Let’s rewind a bit and look at how the Fed rate has evolved over time. The Fed started setting interest rates way back in 1913, but it wasn’t until the 1980s that the rate became a central focus for monetary policy. Remember the double-digit inflation of the late '70s? Yeah, that was a mess. Enter Paul Volcker, the Fed chairman who jacked up the rates to near 20% to crush inflation. Tough love, but it worked.

Fast forward to the 2008 financial crisis, and the Fed slashed rates to near zero to stimulate the economy. Since then, we’ve seen some ups and downs, with rates climbing again in recent years as the economy recovered. But here’s the kicker: the Fed rate isn’t just about the past; it’s about what’s coming next.

Key Historical Moments in Fed Rate Policy

- 1970s: High inflation prompts aggressive rate hikes.

- 1980s: Volcker era sees rates peak at 20%.

- 2008: Rates drop to near zero during the Great Recession.

- 2020: Pandemic triggers another round of near-zero rates.

How the Fed Rate Works

Now that we know what the Fed rate is, let’s talk about how it actually works. The Federal Reserve doesn’t just pull numbers out of a hat. They meet regularly—eight times a year, to be exact—at the Federal Open Market Committee (FOMC) meetings. During these meetings, they assess the health of the economy and decide whether to raise, lower, or keep the Fed rate steady.

But here’s the cool part: the Fed rate influences other rates too. When the Fed raises its rate, it affects everything from credit card interest to car loans. It’s like a domino effect, where one small change can have massive repercussions. And that’s why everyone pays so much attention to what the Fed does.

Effects on the Economy

The Fed rate has a profound impact on the economy, and it’s not just about numbers on a spreadsheet. When the rate goes up, it tends to slow down economic growth because borrowing becomes more expensive. On the flip side, lowering the rate can stimulate growth by making loans more affordable. It’s a delicate balance, and the Fed has to walk a tightrope between encouraging growth and preventing overheating.

For example, during economic downturns, the Fed often lowers rates to encourage spending and investment. But if they keep rates too low for too long, it can lead to inflation, which erodes purchasing power. That’s why the Fed has to constantly monitor and adjust the rate based on economic conditions.

Key Economic Indicators the Fed Considers

- GDP growth

- Unemployment rates

- Inflation levels

- Consumer spending

Controlling Inflation with Fed Rate

Inflation is one of the Fed’s biggest concerns, and the Fed rate is their primary tool for keeping it in check. Think of inflation as the price of goods and services rising over time. If inflation gets too high, it can wreak havoc on the economy. That’s why the Fed targets an inflation rate of around 2%, using the Fed rate to keep things stable.

When inflation starts creeping up, the Fed might raise rates to cool things down. This makes borrowing more expensive, which slows down spending and helps bring prices back under control. Conversely, if inflation is too low or even negative—a situation known as deflation—the Fed might lower rates to encourage spending and investment.

Impact on Personal Finance

So, how does the Fed rate affect you personally? Well, if you’ve got a mortgage, a car loan, or even a credit card, you’re feeling the effects of the Fed rate every day. When rates rise, so do your monthly payments. If you’re saving money in a bank account, higher rates mean you might earn more interest on your deposits. But if you’re borrowing, those higher rates can hit your wallet hard.

Let’s say you’re thinking about buying a house. If the Fed raises rates, your mortgage might become more expensive, making it harder to afford that dream home. On the other hand, if rates are low, it might be a great time to lock in a favorable loan. It’s all about timing and understanding the bigger picture.

How Fed Rate Affects Different Types of Loans

- Mortgages: Higher rates mean higher monthly payments.

- Credit Cards: Variable rates can fluctuate with Fed rate changes.

- Car Loans: Rates can impact monthly payments and affordability.

Factors Affecting Fed Rate Decisions

Alright, so we’ve talked about what the Fed rate does, but what factors influence the Fed’s decision to raise or lower it? There are a bunch of things they consider, from global economic trends to domestic job growth. Here are a few key factors:

1. Economic Growth: If the economy is growing too fast, the Fed might raise rates to prevent overheating. Conversely, if growth is sluggish, they might lower rates to stimulate activity.

2. Employment: The Fed keeps a close eye on unemployment rates. If jobs are scarce, they might lower rates to encourage hiring. But if the job market is tight, they might raise rates to prevent inflation.

3. Inflation: As we’ve discussed, inflation is a major concern. If prices are rising too quickly, the Fed will likely hike rates to bring things under control.

Other Influential Factors

- Global Trade Trends

- Consumer Confidence

- Political Stability

Global Implications of Fed Rate Changes

While the Fed rate is primarily focused on the U.S. economy, its effects are felt around the world. When the Fed raises rates, it can strengthen the dollar, making it more attractive to investors. This can lead to capital flowing out of other countries and into the U.S., affecting their economies. Conversely, when rates are low, the dollar might weaken, impacting global trade and investment flows.

Emerging markets, in particular, are sensitive to Fed rate changes. A stronger dollar can make it harder for these countries to repay their debts, which are often denominated in U.S. currency. It’s a complex web, and the Fed has to consider global implications when making its decisions.

Future Trends in Fed Rate Policy

So, where is the Fed rate headed in the future? That’s the million-dollar question, and the answer depends on a variety of factors. With the ongoing recovery from the pandemic, many experts expect rates to remain relatively low for the foreseeable future. However, as the economy continues to grow, the Fed might gradually increase rates to prevent overheating.

One thing’s for sure: the Fed will keep a close eye on inflation, employment, and global economic trends. They’ll adjust the rate as needed to maintain stability and promote sustainable growth. And as always, we’ll all be watching closely to see what happens next.

Predictions for the Next Decade

- Gradual rate increases as the economy stabilizes.

- Potential for higher inflation if global supply chains remain disrupted.

- Increased focus on climate change and its economic impacts.

Conclusion: Why You Should Care About the Fed Rate

Let’s wrap things up. The Fed rate might seem like a dry, technical topic, but it has real-world implications for all of us. Whether you’re a homeowner, a business owner, or just someone trying to make ends meet, understanding the Fed rate can give you a leg up in navigating the financial landscape.

So, the next time you hear about the Fed making a move, don’t tune it out. Pay attention, because it could affect your wallet in ways you might not expect. And if you’ve learned something from this article, do me a favor—share it with a friend. Knowledge is power, and the more we understand about the economy, the better off we’ll all be.

Thanks for sticking around, and remember: the Fed rate isn’t just for economists—it’s for all of us. Stay informed, stay ahead.

Dolly Parton Husband: The Untold Love Story You Need To Know

Texas, Tre Johnson Kicked From NCAA Tournament: A Deep Dive Into The Controversy

What Does The Department Of Education Do? A Comprehensive Guide To Understanding Its Role And Impact

Fed interest rate SeetaDenholm

Fed Rate Increases 2025 Tiff Shandra

Fed Increase Rate 2024 Tarah Charlotte